In Florida, contesting a will is done through probate court. In most cases, challenges to a will must be submitted before the probate process is complete. More specifically, the challenge must be filed within three months of receiving notice regarding the will; this duration can be extended if notice was not provided and the probate process is still ongoing. There are many reasons for contesting a will in Florida; this ranges from issues with the document itself, to unfortunate foul play from a family member, caregiver, or another party. Needless to say, these cases can be highly complex and emotionally draining for those involved; therefore, legal representation by a Florida probate lawyer experienced in will contests is extremely vital for your case.

The attorneys at Di Pietro Partners have decades of experience in Florida probate litigation cases including will contests. If you have legal issues with a will anywhere in the State of Florida, call our lawyers for a free and confidential case evaluation today. 1.800.712.8462

Page Navigation

Legal Reasons To Contest Wills

Why Hire Us?

The attorneys at Di Pietro Partners have decades of trial experience in estate litigation matters that involve Florida wills. This experience includes representing both personal representatives and executors, as well as beneficiaries that have been removed from the estate or have other valid legal objections over the probate of a will.

Our lawyers are dedicated to client success. It’s our objective to provide you with the absolute best legal representation that is custom suited to your individual needs. We are large enough to take on complex litigation matters yet small enough to provide personalized service and give our full attention to your case.

The knowledge, experience, and dedication offered by our law firm serves as a powerful ally when navigating your legal issue. Depending on your case, we can successfully negotiate a substantial settlement out of court, or fight vigorously on your behalf at trial.

Reasons For Contesting a Will in Florida

In order for a will to be contested in Florida, valid legal grounds are required. Someone cannot simply contest a will because they disagree with the division of assets, or have a bad relationship with a testor/beneficiary. With that said, there are circumstances where a will can be disputed in a court of law; these circumstances include, but are not limited to the following:

Validity

This remains one of the most common reasons for challenging a will. This may include challenging the validity of a will based on the competency of the party drafting the will, disputing the validity of a will based upon the existence of additional or subsequent documents, or challenging validity based upon undue influence over the decedent prior to death.

Undue Influence

Contesting a will on the grounds of undue influence basically contends that a third party manipulated someone into altering a will for their own personal gain. This may include executing or modifying the document or removing one or more of the beneficiaries from the estate.

This is the most common dispute over the validity of a will or trust. In order to successfully challenge a will based on undue influence, several factors must be present. These factors include:

- The individual must have substantial benefit under the will

- The person must possess a confidential relationship with the decedent

- The individual was active in procuring the will

Removal of a Beneficiary From The Estate

In cases where a beneficiary was improperly removed from the will, they have grounds to file a dispute in court. For example, if someone coerces an elderly individual with Altzheimer’s or Dementia to remove another beneficiary from the will for the sake of their own personal gain, this action is unlawful and can be disputed in court.

Lack of Testamentary Capacity

Wills need to be formally drafted, signed, witnessed, and executed by someone with full mental capacity. In other words, this individual must possess the ability to comprehend the assets, beneficiaries, and effect of the document. Common reasons a will is contested on the grounds of mental capacity involves testors with late-life diseases such as alzheimer’s and dementia. Other factors that may contribute to diminished mental capacity include: brain injuries, disability, intoxication (including prescribed medication), and more.

Insane Delusion

This is another form of “mental incapacity.” In these cases, the person drafting or executing the will did so while they could legally declared as “insane.” The Supreme Court of Florida defines this as “fixed false belief without hypothesis, having no foundation in reality.”

Lack of Testamentary Capacity due to insane delusion or another form of incapacity will effectively render the entire will as invalid.

Under Duress

If a will was executed, modified, or signed due to the threat of physical harm against the testator, needless to say, the execution of the will was not valid and is subject to litigation.

Estate Fraud

If a will is executed under false pretenses, it may be contested. For instance, if a beneficiary lies or misrepresents facts to the testor, and the will is altered based on these false facts, victims may challenge the will.

Here are examples of fraud when it comes to wills:

- Fraud in the Execution (i.e. not telling the testor they’re signing a will)

- Fraud in the Inducement (i.e. misleading the testor into thinking they “need” to sign it)

- Misrepresentation (i.e. lying about what signing the will entails)

Forgery

Needless to say, if a will, or any other legal document is fraudulently signed, it’s considered invalid in a court of law.

Improper Execution of the Will

Simply put, if a will was not properly signed, drafted, or witnessed, it can be contested in court. Under Florida law, this includes a proper signature by the testator of the will along with two witnesses. Florida Statute 732.502 details the specific process involved in valid execution of a will. According to the Statute, “The testator must sign the will at the end; The testator’s name must be subscribed at the end of the will by some other person in the testator’s presence and by the testator’s direction…” (The Florida Senate, 732.502 Execution of wills, 2011)

When Someone Passes Away Without a Will

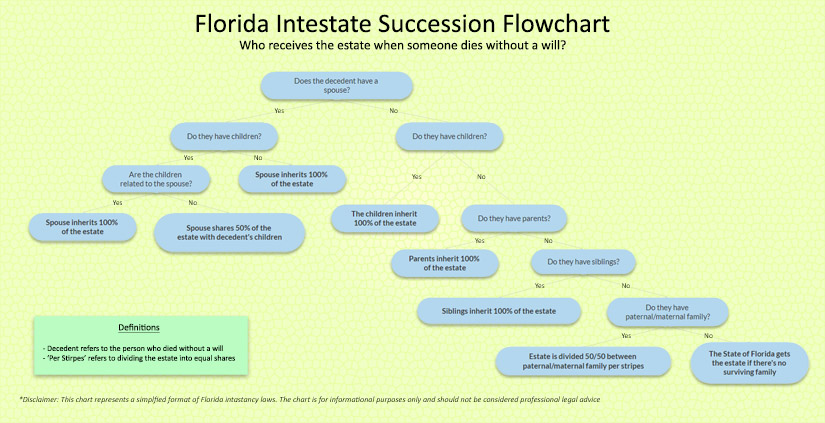

In cases where a family member passes away without a valid will, their property will be declared “intestate” and the courts will have to use a specific process to determine which family member receives assets of the deceased. To simplify this process for readers, we’ve prepared a flowchart on Florida intestate-succession.

As discussed, this is a summarized version of the Florida probate law specific to intestate succession and wills. The full laws are more in-depth and have various exceptions depending on several circumstances. To put this in perspective, here’s an excerpt from Section 732.108 of the Florida Statutes regarding adopted children/children born out of wedlock.

“For the purpose of intestate succession by or from an adopted person, the adopted person is a descendant of the adopting parent and is one of the natural kindred of all members of the adopting parent’s family, and is not a descendant of his or her natural parents, nor is he or she one of the kindred of any member of the natural parent’s family or any prior adoptive parent’s family, except that:

(a) Adoption of a child by the spouse of a natural parent has no effect on the relationship between the child and the natural parent or the natural parent’s family.

(b) Adoption of a child by a natural parent’s spouse who married the natural parent after the death of the other natural parent has no effect on the relationship between the child and the family of the deceased natural parent.

(c) Adoption of a child by a close relative, as defined in s. 63.172(2), has no effect on the relationship between the child and the families of the deceased natural parents…” (The Florida Legislature, 2018, Adopted persons and persons born out of wedlock.)

As you can see, this process is very in-depth and often causes confusion and disagreements among beneficiaries which may ultimately lead to contested intestate probate. As a result, it’s vital to work with a Florida probate attorney that’s experienced with intestate succession.

Types Of Wills

Wills are an essential part of any estate plan and are applicable to anyone regardless of the size of their estate. Wills serve many purposes; for instance, they help provide care for loved ones after someone’s passing, detail funeral arrangements, and detail how assets are distributed post-mortem. The State of Florida has a specific process for the drafting, witnessing, and execution of a will. If this process is not properly followed, then the will has a better chance of being successfully challenged in probate court.

There are many different variations of wills; however, only certain wills are legally recognized in a given State. Below are some of the most commonly used wills in the State of Florida.

Simple Will

As the name may suggest, this will is the most common, and the most “straightforward” compared to others. Basically, a simple will is a legal document that details wishes of the person writing the will (the testator). This includes: the distribution of assets after death, care for family members, and more. This is commonly known as the “last will and testament.”

Pour-Over Will

Simply put, this is very similar to a “simple will;” however, one difference is that the pour-over will dictates what property/assets should be placed in a trust after your passing.

Complex Will

As the name indicates, a complex will is more in-depth. This will is commonly used for estates that are large and/or have specific conditions such as: estate taxes, special needs trusts, etc.

Testamentary Will

The testamentary will actually involves setting up a trust within a will. In fact, the real name of this document is “testamentary trust,” and is commonly referred to as “will trust” or “trust under will.” This provides more flexibility for an estate planning strategy in several ways including the potential in reducing/avoiding estate taxes.

Common Questions About Contesting Wills

How long do you have to contest a will?

This depends on the circumstances of your case. Generally speaking, a will can be contested at any time before the probate process is finished. Probate involves submitting a will to the local county court where the individual resides at the time of death. Once a will is filed, it’s required that creditors, beneficiaries, etc. are provided notice. Once notice is provided, you have 90 days to challenge the will before the probate process is complete.

After this 90 day window is closed, you generally cannot challenge a will; however, there are exceptions to this rule. For instance, if someone was prevented from contesting the will due to fraudulent activity (i.e. failure to provide notice of the decedent’s passing) then you can file a claim even after the will is probated.

In short, you generally have 90 days to legally dispute the will during probate; however, this time period can be extended for cases involving unlawful activity.

Who can challenge a will?

Beneficiaries named within the will, who were removed from the will, or any other “interested party” in the estate can challenge the will provided they have valid legal grounds to do so.

What if someone dies without a will?

When someone dies without a valid will, assets/property are considered “intestate” and the probate process becomes more lengthy and complex. If someone dies intestate, the State of Florida will try and determine who receives assets based on relation to the deceased individual. In other words, these assets will generally go to a spouse, or family member. We wrote an article on intestate succession that covers this topic in greater detail.

Do you need a lawyer?

Whether you’re a personal representative, executor, beneficiary, or other interested party, you absolutely require a legal professional when it comes to legal disputes involving wills. In these cases, you should obtain council from an experienced estate litigation lawyer who specializes in will contests within your state.

Do you represent beneficiaries?

Yes, the estate lawyers at Di Pietro Partners are highly experienced in representing beneficiaries with valid legal disputes involving Florida wills. This includes cases involving misconduct by the personal representative, estate fraud, improper execution, undue influence, removal from an estate, and more.

Do you defend executors and personal representatives?

Yes, our attorneys have decades of trial experience in probate litigation cases involving will and trust contests. This includes defending executors, personal representatives, and others against lawsuits from beneficiaries or other parties involved in estate disputes.

Get Help Today

The lawyers at Di Pietro Partners are highly experienced in cases involving probate and wills. Our main office is in Ft. Lauderdale, FL and we’re dedicated to serving clients involved in estate litigation cases anywhere in Florida. This includes clients who are currently located outside the State, but have matters related to probate litigation/contesting a will in Florida. If you believe you have valid legal grounds to dispute a will, or are being wrongfully challenged and need proper defense, call our offices for a free consultation today.