Trust administration involves management of assets within a trust in accordance with the documents terms. Someone who creates a trust is called a settlor, while the individual responsible for managing a trust is known as a trustee. On the other hand, individuals who receive benefits from the trust are called the beneficiaries.

In Florida, trustees have many important duties and functions. For example, trustees are responsible for ensuring assets are handled in accordance with the wishes of the settlor. Trustees are also responsible for legal and financial aspects such as filing estate tax returns, and in some cases, paying the settlor’s debts.

In short, trustees have a legal responsibility to distribute assets within the trust to the named beneficiaries in accordance with the wishes of the deceased. It’s vital to work with an attorney that’s experienced with probate and trusts to ensure the correct process is followed.

Florida Trust Administration Overview

Setting up a trust allows an individual to establish specific terms on how certain assets are managed and distributed. Trusts serve many purposes; for instance, they can help provide care for children, provide income to individuals with disabilities, and help reduce/avoid estate taxes and probate.

Some people use trusts to provide for the distribution of their assets at death, or during life, rather than a will. The trustee named in the trust document typically handles the administration of the trust after the death of the maker of the trust (formally called the “grantor” or “settlor”) of the trust. Other than avoiding the Florida probate process, the same principles of law apply to the administration of trusts in Florida as are applicable to wills.

The laws involving the administration of trusts after someone passes away are far more involved than the administration of a will. In short, trustees have a legal responsibility to distribute assets within the trust to the named beneficiaries in accordance with the wishes of the deceased. It’s vital to work with an attorney to ensure the correct process is followed.

If the correct process isn’t followed, the trust may be subject to litigation in court.

Types of Trusts

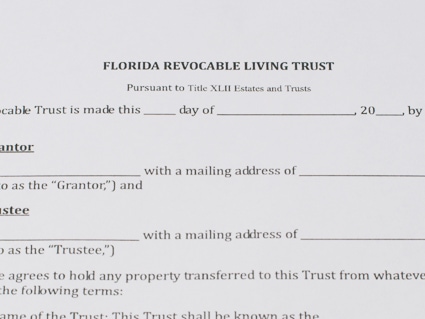

There are many different variations of trusts; however, trusts are commonly categorized in two ways; “revocable” and “irrevocable.” In simple terms, a revocable trust can be altered or canceled by the grantor while an irrevocable trust cannot be canceled or changed without the consent of beneficiaries. With that said, below are some of the most commonly used trusts in the State of Florida.

Living Trust – The living trust is the most commonly used type of trust. Although this trust can technically be set up as either revocable or irrevocable, it’s most often set up as a revocable trust and is commonly referred to as simply the “Revocable Trust,” or “Revocable Living Trust.” Simply put, this document dictates how certain assets should be managed during someone’s life and distributed after death. Formally transferring assets to a trust prior to death is a process known as “funding,” hence, the commonly known term, “trust fund.”

Testamentary Trust – The testamentary trust is actually created within a will. As a result, this is commonly known as a “testamentary will,” “trust under will, or “will trust.” Since the testamentary trust is set up in a will, it does not take effect until after death. This trust allows more flexibility in an estate planning strategy in several ways. For instance, it can help reduce/avoid estate taxes.

Domestic Asset Protection Trust –The Domestic Asset Protection Trust is commonly referred to as “DAPT.” This trust serves as a protection against creditors. As the name suggests, the trust is also used to protect assets from a spouse in the event a marriage is successful. The way it works is that assets are transferred to the trust so that the settlor can legally name themselves as beneficiary for said assets.

Other Types Of Trusts – Although the aforementioned trusts are the most commonly used and adequately serve estate planning needs for most individuals, there are many other types of trusts for more specialized/specific needs. One additional type is a “charitable trust” in which someone uses a trust fund to provide a gift to a charitable organization while still receiving benefits themselves. Other more specialized trusts include, but are not limited to: grantor trusts, gun trusts, special needs trusts, etc.