Whistleblower Healthcare Fraud Attorneys

Healthcare fraud encompasses a broad range of illegal activities that exploit federal and private healthcare programs, including Medicare and Medicaid, for financial gain. These programs allocate billions of dollars annually to provide essential services to diverse populations, including the elderly, low-income families, and individuals with special healthcare needs. The vast scale and complexity of these healthcare systems, combined with the significant funds involved, make them prime targets for fraudulent activities.

The healthcare fraud lawyers at Di Pietro Partners represent whistleblowers. We understand the courage it takes to step forward and the importance of ensuring your rights and interests are protected throughout the process.

Our attorneys work on a contingency fee basis for whistleblower cases, meaning you won’t pay any legal fees unless we recover funds on your behalf. This approach aligns our success with yours and allows you to pursue justice without financial risk.

If you suspect healthcare fraud and are considering taking action, don’t navigate this challenging landscape alone. Contact our law firm for a free consultation today.

Our Healthcare Fraud Lawyers on TV

What is Healthcare Fraud/Abuse?

Healthcare fraud or abuse refers to illegal practices aimed at exploiting federally funded healthcare programs for financial gain. For example, Medicare is designed to provide healthcare services to the elderly and low-income individuals and disburses over one trillion dollars annually. Given the program’s vast scale and intricate nature, effective detection and prevention of fraud are heavily dependent on the vigilance of whistleblowers.

Medicare and Medicaid fraud manifest in various forms, all sharing the common goal of illicit financial gain. Some prevalent types of fraud include:

Billing for Services Not Rendered – This involves healthcare providers submitting claims for procedures or services that patients did not actually receive. An example would be a therapist billing Medicare for comprehensive physical therapy treatments when only basic massage therapy was provided.

Upcoding – In this scenario, providers intentionally use higher billing codes for services or procedures than what was actually performed, aiming to receive higher reimbursements than they are entitled to.

Unnecessary Procedures – Billing Medicare or Medicaid for procedures that are medically unnecessary, purely to increase billing amounts, constitutes fraud. This is particularly concerning when it targets vulnerable populations, such as the elderly without family oversight.

False Documentation – This encompasses a range of deceptive practices, including billing for procedures that were never performed, patients that were never seen, or home health care visits that never occurred.

Identifying and addressing healthcare fraud is crucial for the integrity of these healthcare programs. Legal mechanisms and protections are in place to support whistleblowers in reporting such activities, ensuring that funds are used appropriately to benefit those in genuine need of medical care.

How to Report Healthcare Fraud

Reporting healthcare fraud is a critical step in safeguarding the integrity of healthcare services and ensuring that resources are allocated appropriately. If you suspect fraudulent activities, the following steps are crucial:

– Gather Documentation – Collect any evidence related to the suspected fraud. This could include billing statements, emails, internal reports, or any other documents that could substantiate your claims. Ensure that you adhere to company policies and legal regulations when obtaining these documents to avoid any personal legal repercussions.

– Write a Detailed Memo – As soon as possible, document your observations and the specifics of the suspected fraud in a memo to yourself. Given that legal proceedings and investigations can extend over several years, this memo can serve as a vital record, preserving the accuracy of your recollections and observations.

– Compile a List of Relevant Documents – Make a list of any additional documents that could be pertinent to your case but are not currently in your possession. This could include internal records, billing information, or correspondence that you know exists but do not have direct access to. This list can guide investigators and legal representatives in their inquiry.

– Contact a Healthcare Fraud Attorney – Reach out to a law firm specializing in Medicare fraud. These firms are well-versed in the complexities of healthcare fraud cases and can provide the necessary legal guidance and representation. They can assist in navigating the legal system, ensuring that your report is filed correctly, and that you are protected throughout the process.

– Report to Government Authorities – In addition to working with a healthcare fraud lawyer, you can report suspected Medicare fraud directly to government authorities. This can be done through the Office of the Inspector General (OIG) of the U.S. Department of Health and Human Services (HHS), or through the Medicare fraud hotline.

– Consider Whistleblower Protections – If you are reporting fraud within your organization, consider the protections afforded to whistleblowers under federal and state laws. These laws can offer protection from retaliation, ensuring that individuals who report wrongdoing are not unjustly penalized.

By following these steps, you can play a crucial role in combating healthcare fraud, contributing to a more ethical and sustainable healthcare system. Remember, effective reporting starts with accurate documentation and seeking the right legal and professional guidance.

Types of Healthcare Fraud

Healthcare fraud takes various forms. One common trait each fraudulent act shares is the desire to exploit the government for financial gain. In other words, the perpetrators want to make money. Some common types of healthcare fraud include:

- Billing for services not rendered: For example, a physical therapy practice may only provide massage therapy to patients. However, the therapist bills Medicare for ultrasound, traction, electrotherapy, ice, and heat. Each service has a code and cost involved. Thus, the therapist gets paid more for services not received by the patient. Simply put, the therapist has committed Medicare fraud.

- Coding: Providers intentionally assign a higher billing code to a service or procedure. This is illegal when the code is purposely written incorrectly to obtain higher reimbursement.

- Unnecessary procedures: Any unnecessary procedure billed to Medicare or Medicare is considered fraud. If an employee of any medical practice sees this happening, they should contact an attorney and report it. Sadly, this may happen to the elderly when no family oversees their care.

- False documentation: Billing for procedures never performed, or billing for patients not seen at the practice is illegal. Also, billing for home health care visits that never happened is fraud. Once again, employees should seek legal guidance if this is happening where they work.

- Kickbacks and Referrals: This involves receiving or offering financial incentives in exchange for the referral of patients covered by Medicare or Medicaid. It’s a violation of the Anti-Kickback Statute, aiming to ensure that medical providers’ judgments are not compromised by improper financial incentives.

- Phantom Billing: Similar to billing for services not rendered but extends to billing for more expensive services than those actually provided or billing multiple times for the same service.

- Upcoding of Patient Diagnosis: More severe than the incorrect coding of procedures, this involves exaggerating a patient’s diagnosis to justify unnecessary tests or procedures that generate higher payments from Medicare or Medicaid.

- Prescription Fraud: Involves prescribing unnecessary medications, sometimes in collusion with a pharmacy, to bill Medicare or Medicaid for medications not needed by the patient. It also includes pill mill schemes where medications, especially opioids, are prescribed without legitimate medical reasons.

- Identity Theft: Using another person’s Medicare or Medicaid information to receive healthcare services or to bill for services not rendered.

- Equipment Fraud: Billing for medical equipment, supplies, or prosthetics that were either not provided or not medically necessary. This could include durable medical equipment like wheelchairs or diabetic supplies.

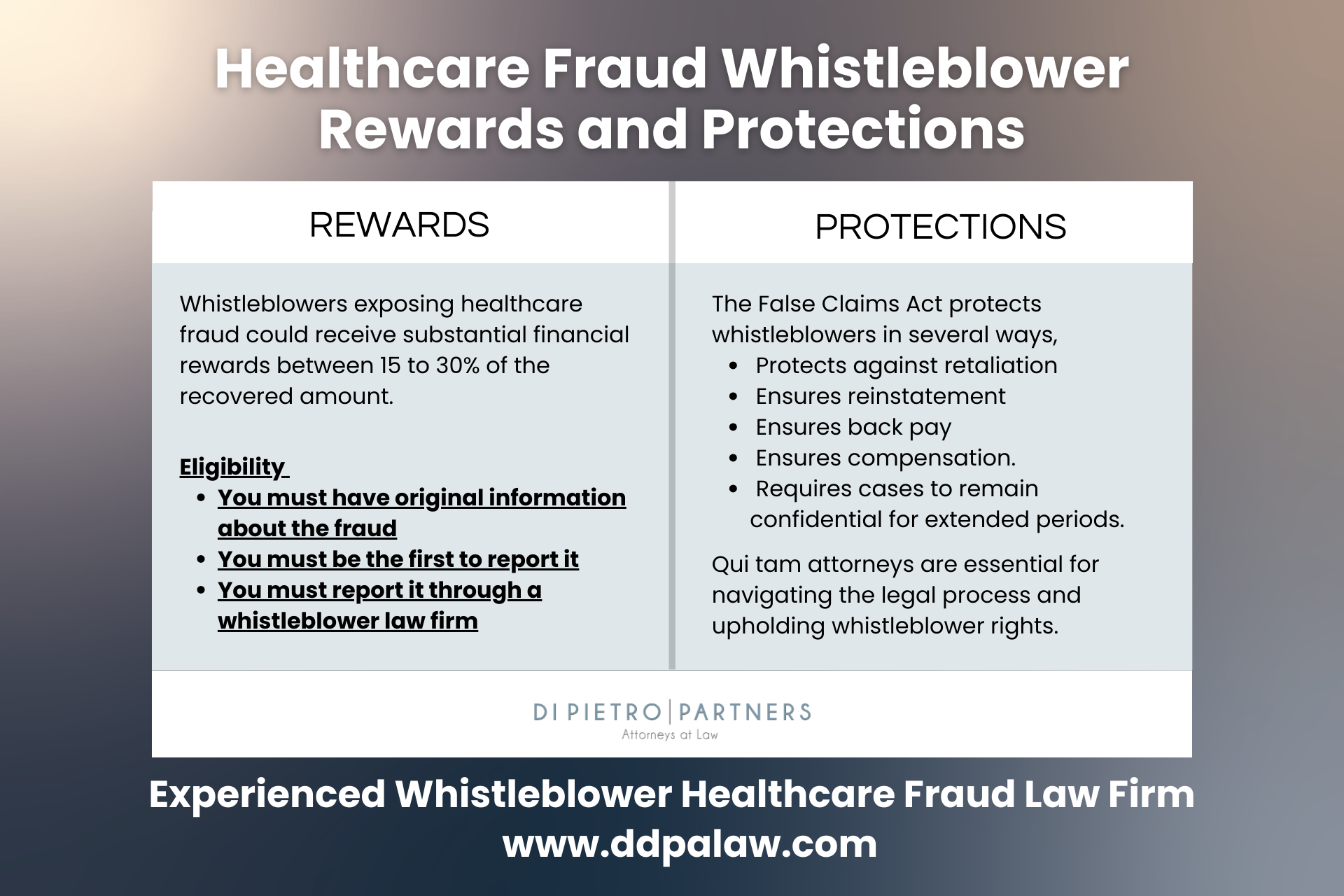

Healthcare Fraud Whistleblower Rewards

Whistleblowers are indispensable in the fight against healthcare fraud, serving as the frontline in identifying and reporting fraudulent activities within Medicare and other healthcare programs. The law empowers these individuals, giving them the right to file lawsuits on behalf of the government against entities defrauding government healthcare programs. Known as qui tam relators, these whistleblowers need the expertise of seasoned healthcare fraud attorneys to navigate the complexities of such legal actions effectively.

Filing a qui tam lawsuit with the guidance of a knowledgeable healthcare fraud attorney can lead to substantial rewards for whistleblowers. Should the lawsuit prove successful, a whistleblower can receive up to 30% of the funds recovered from the fraudulent activities. This percentage can vary, especially if the government decides to intervene and actively participate in the case, which may affect the portion of the recovery awarded to the whistleblower.

Recognizing Medicare or Medicaid fraud often stems from close observation and questioning of practices within one’s workplace. Whether it’s being asked to partake in questionable billing practices or noticing inconsistencies that suggest fraudulent activities, these are significant red flags. It’s crucial for individuals who suspect fraudulent actions against Medicare or Medicaid to consult with a specialized healthcare fraud attorney. These professionals can offer invaluable advice on how to proceed safely and effectively, ensuring that whistleblowers are protected and rewarded for their courage and initiative in exposing fraud.

For anyone aware of healthcare fraud, taking action is not just a moral duty but also a legally supported decision that can lead to significant financial rewards and contribute to the integrity and sustainability of vital healthcare programs. Consulting with a healthcare fraud attorney is the first step in this impactful journey.

How We Can Help

The journey begins with an exhaustive evaluation of the alleged fraud. Our legal team meticulously assesses the details, leveraging our extensive expertise to determine the feasibility of pursuing a whistleblower (qui tam) case under the False Claims Act. This critical first step ensures that the foundation of the case is robust and meets the stringent legal criteria required for whistleblower actions.

Should the evidence point towards a viable case, our attorneys then embark on the intricate process of filing a qui tam lawsuit. This process is characterized by the careful preparation and presentation of detailed evidence, documenting the fraudulent activities comprehensively. We aim to construct a compelling case for the government, highlighting the misconduct’s scope and its repercussions on the Medicare program, thereby facilitating the successful prosecution and recovery of unlawfully obtained funds.

Our involvement doesn’t end with the filing of the lawsuit; we remain actively engaged throughout the prosecution phase, working in concert with government officials. Our collaborative efforts are aimed at ensuring that justice is served, leveraging our legal acumen to assist in navigating the complexities of healthcare fraud litigation.

In partnering with Di Pietro Partners, whistleblowers gain not just legal representation, but advocates committed to the principles of justice and integrity in healthcare. Our attorneys are here to guide you through each phase of the legal process, offering expertise, support, and a determined pursuit of a successful outcome. If you suspect healthcare fraud and are contemplating taking action, let us stand with you. Together, we can make a significant impact in the fight against healthcare fraud, safeguarding resources intended for the welfare of patients and the healthcare system at large.

Why Choose Us

Choosing Di Pietro Partners for your healthcare fraud case means securing a team uniquely equipped to navigate the complexities of healthcare law. With a robust team that includes healthcare lawyers, board certified physicians, and former government administrators, all with decades of experience, the firm brings an unparalleled depth of expertise to every case.

David Di Pietro, a seasoned healthcare and medical malpractice lawyer with over a decade of experience, has successfully represented clients through a myriad of complex healthcare issues, from misdiagnosis to medication errors. His extensive trial experience and regular appearances on national TV as an expert on significant cases, like the Purdue Pharma Opioid Lawsuit, demonstrate his commitment and aggressive approach to achieving justice for his clients.

Dr. Tiffany Di Pietro, serving as the medical advisor, adds an invaluable medical perspective to the team. As the youngest graduate from Nova Southeastern University’s College of Osteopathic Medicine and quadruple board-certified in several medical specialties, her expertise enhances the firm’s ability to scrutinize medical documents and evidence critically. Her frequent national news appearances underscore her role as a respected voice in the medical community.

By choosing Di Pietro Partners, you’re not just hiring a law firm; you’re enlisting a dedicated team of legal and medical experts committed to delivering justice and the best possible outcomes for their clients. Their comprehensive approach to handling Medicare fraud cases, combining legal prowess with medical insight, sets them apart as a premier choice for anyone seeking representation in complex healthcare litigation.

Federal Healthcare Fraud Laws

Federal healthcare fraud laws serve as the cornerstone of efforts to maintain the integrity and efficacy of healthcare programs across the United States, including Medicare and Medicaid. These laws form a comprehensive legal framework aimed at deterring and punishing fraudulent activities that misuse or deceive federal healthcare funds. The statutes and regulations underpinning these laws are multifaceted, designed to address a broad spectrum of fraudulent behaviors within the healthcare system. Here’s a succinct overview of pivotal federal statutes that safeguard against healthcare fraud:

False Claims Act (FCA) – This act prohibits knowingly submitting false claims to obtain a federal payment. Under the FCA, individuals and companies can be held liable for submitting fraudulent claims to Medicare. The FCA also includes whistleblower provisions, allowing private individuals to file lawsuits on behalf of the government and share in any recovered damages.

Anti-Kickback Statute (AKS) – The AKS makes it illegal to knowingly and willfully offer, pay, solicit, or receive any remuneration to induce referrals of items or services covered by federally funded programs, including Medicare. The AKS aims to ensure that medical decisions are based on the best interests of patients rather than on inappropriate financial incentives.

Physician Self-Referral Law (Stark Law) – Specifically targeting Medicare and Medicaid fraud, the Stark Law prohibits physicians from referring patients to receive designated health services payable by Medicare or Medicaid from entities with which the physician or an immediate family member has a financial relationship, unless an exception applies.

Health Care Fraud Statute – This statute makes it a criminal offense to knowingly and willfully execute, or attempt to execute, a scheme to defraud any healthcare benefit program or to obtain, by means of false or fraudulent pretenses, representations, or promises, any money or property owned by, or under the custody or control of, any healthcare benefit program.

Violations of these laws can result in severe penalties, including fines, restitution, and imprisonment. The federal government, through various agencies such as the Department of Health and Human Services’ Office of Inspector General (HHS-OIG) and the Department of Justice (DOJ), enforces these laws rigorously. These agencies work together to investigate and prosecute Medicare fraud cases, recover stolen funds, and implement measures to prevent future fraud.

Other Types of Healthcare Fraud

Besides Medicare fraud, the healthcare industry faces various other types of fraud that can significantly impact both the financial integrity of healthcare systems and patient care. These include:

Medicaid Fraud – Similar to Medicare fraud, Medicaid fraud involves illegal practices aimed at exploiting the Medicaid program, which provides health coverage to millions of Americans, including eligible low-income adults, children, pregnant women, elderly adults, and people with disabilities. Fraudulent activities can include billing for services not rendered, upcoding, and billing for medically unnecessary services.

Private Insurance Fraud – This type of fraud involves submitting false or exaggerated claims to private health insurance companies. Tactics include billing for services not provided, double-billing both the insurance and the patient, and performing unnecessary procedures to increase billing.

Prescription Drug Fraud – Prescription drug fraud can involve various schemes, including “doctor shopping” to obtain multiple prescriptions, forging or altering prescriptions, and illegal distribution and sale of prescription medications. Pharmaceutical companies may also engage in fraud through off-label marketing or manipulating prices.

Kickbacks and Referral Schemes – Illegal kickbacks involve receiving or paying something of value in exchange for referrals for services that will be billed to a healthcare program. The Anti-Kickback Statute specifically targets this type of fraud to ensure medical decisions are based on patient needs rather than financial incentives.

Provider Identity Theft – Fraudsters may use a healthcare provider’s identity to submit false claims for services never rendered or to obtain controlled substances for illegal distribution. This not only defrauds healthcare programs but also damages the reputation of the providers whose identities are stolen.

Upcoding and Unbundling – Upcoding involves billing for a more expensive service than was actually provided, while unbundling refers to billing each step of a procedure as if it were a separate procedure to increase the total bill. Both practices are illegal and inflate healthcare costs fraudulently.

False or Exaggerated Claims for Disability Benefits – Submitting false or exaggerated claims to obtain disability benefits from government or private insurers constitutes fraud. This can include misrepresenting one’s health condition, employment status, or income.

Addressing these types of healthcare fraud requires vigilant monitoring, strict enforcement of laws, and public awareness. Healthcare fraud not only drains resources but also compromises patient care and increases costs for everyone in the healthcare system.

Medicare Fraud Case Studies

Recently, numerous Medicare whistleblower cases have made the news. The lawsuits became newsworthy due to the large amounts of money involved in fraudulent schemes and the huge penalties attached to committing these crimes. Noteworthy cases include:

- The U.S. Department of Justice Office of Public Affairs issued a press release on Tuesday, January 30, 2024. The article explained how a California man was sentenced to 10 years in prison for billing Medicare approximately $234 million for various lab tests, despite the fact he was excluded from participating in Medicare. The man was previously convicted in 1990 and 2001 in New York and California. After each conviction, he was ordered NOT to participate in Medicare or Medicaid programs. Evidently, he didn’t listen. In addition to 10 years in prison, he must forfeit $31,761,286.21, two residential properties, and one business property.

- A Florida businessman was ordered to pay $27 million for Medicare fraud. He billed Medicare for cancer genomic testing that was not medically necessary. It’s important to note, he owned the diagnostic laboratory.

- A Pennsylvania pharmacist submitted claims to Medicare Part D which is the prescription part of the plan. Well, the claims were then traced to non-existent orders and the drugs were never given to any patients. The pharmacist pled guilty and was sentenced to 15 months in prison and $166,000 restitution.

- Operation Brace Yourself (2019) – Over $1.2 billion in fraudulent claims made by dozens of healthcare executives and telemedicine executives led to charges. The group billed Medicare for equipment never used or received.

- Michigan doctor’s chemotherapy fraud (2014) – This was a horrific case. Dr. Farid Fata was convicted of administering chemotherapy to over 500 patients who didn’t have cancer. Medicare received and paid $34 million of fraudulent claims from this doctor.

Medicaid Fraud Case Studies

Medicaid fraud cases have increased in recent years. In fact, the Medicaid fraud unit receives thousands of referrals each year. In 2023, they received over 4000 referrals. However, only 893 were brought to court. The Medicaid Fraud Control Unit’s Annual Report (2023) further noted that $1.2 billion was recovered and total convictions amounted to 1143 people. Some major Medicaid fraud cases include:

- MedeAnalytics, Inc 2022 – This Company overbilled Medicaid in several states. In the settlement, MedeAnalytics agreed to pay $7 million to Medicaid programs primarily in Texas and California.

- Union Healthcare Services Ambulance – The owner of this company in Texas received a 16 year prison sentence for running a Medicaid fraud scheme.

- New Horizons Durable Medical Equipment – the Texas co-owner of this company was sentenced to 49 months in federal prison for Medicaid fraud.

- Wyeth and Pfizer 2016 – Both pharmaceutical companies failed to provide discounts to Medicaid patients for the drugs Protonix Oral and Protonix IV. Since Medicaid patients should receive the same pricing as any other consumer, the companies received HUGE fines. In fact, $1.2 billion was recovered and million dollar fines were assessed to the companies.

- Vista Clinical diagnostics, LLC, Access Dermpath, and Advanced Clinical Laboratories, Inc. – These companies are alleged to have violated the Federal False Claims Act. The Medicaid Fraud Unit did recover more than $500,000 in this case. This particular case was the result of a whistleblower.

- Advanced Medical Equipment (AME), Louisiana, 2023 – A Louisiana man pled guilty to health care fraud and sentenced to three years in prison. He was supplying unnecessary medical equipment to Medicare and Medicaid patients through his durable medical equipment company. AME received $7.96 million dollars. In order to receive fraudulent funds he forged physician notes and numerous medical records. He made over $3 million dollars on the scheme.

Healthcare Fraud FAQ

Q. What is Medicare fraud?

Medicare fraud or Medicare abuse refers to illegal practices aimed at exploiting the federally funded healthcare program, Medicare for financial gain. Medicare is designed to provide healthcare services to the elderly and low-income individuals and disburses over one trillion dollars annually. Given the program’s vast scale and intricate nature, effective detection and prevention of fraud are heavily dependent on the vigilance of whistleblowers.

Q. What is Medicaid fraud?

Medicaid fraud or Medicaid abuse encompasses illegal activities designed to exploit the federally and state-funded healthcare program, Medicaid, for unauthorized financial gain. Medicaid aims to deliver medical and health-related services to low-income individuals and families, representing a significant portion of healthcare spending in the United States. Due to its extensive reach and complexity, effectively identifying and countering fraud within the Medicaid program relies heavily on the diligence and alertness of whistleblowers. These individuals play a critical role in uncovering fraudulent practices, thereby helping to ensure that Medicaid resources are utilized properly to support those genuinely in need of assistance.

Q. What happens when you report healthcare fraud?

Reporting healthcare fraud initiates a critical process aimed at protecting public funds and ensuring the integrity of healthcare services. When you report such fraud, whether it pertains to Medicare, Medicaid, or any other healthcare program, the information is evaluated by the relevant oversight agency, such as the Office of Inspector General (OIG) or the Centers for Medicare & Medicaid Services (CMS). These agencies assess the provided details to determine the necessity and scope of an investigation.

Q. Where do you report healthcare fraud?

Reporting healthcare fraud, which encompasses Medicare fraud among other types, can be directed to several key entities tasked with safeguarding the integrity of healthcare programs. Reports should be made to the Office of Inspector General (OIG) and the Centers for Medicare & Medicaid Services (CMS), which are pivotal in investigating and addressing fraud within federal healthcare services. Additionally, the Senior Medicare Patrol (SMP) provides valuable assistance and resources for Medicare beneficiaries, aiding in the reporting process and enhancing fraud awareness. When tackling the complex issue of healthcare fraud, consulting with a specialized healthcare fraud law firm can significantly augment the reporting process. Attorneys with expertise in healthcare law play a crucial role, ensuring that your report is not only accurately filed but is also comprehensively documented.

Q. How do you report healthcare fraud anonymously?

If you wish to report healthcare fraud anonymously, it’s advised that you do so through a reputable law firm. When you do it this way, your legal rights are protected through attorney-client privilege. While providing your contact information can be helpful for the investigation, it is not mandatory, and your report can still be submitted and processed anonymously.

Q. What is the cost of a healthcare fraud lawyer?

The cost of hiring a healthcare fraud lawyer can vary widely based on several factors, including the complexity of the case, the lawyer’s experience, and the law firm’s billing practices. The healthcare fraud attorneys at Di Pietro Partners work on a contingency fee basis on whistleblower (qui tam) cases under the False Claims Act. This means the lawyer only gets paid if you win the case or reach a settlement, taking a percentage of the recovered funds as their fee. This percentage can vary but typically ranges from 20% to 40% of the recovery.

Talk to a Healthcare Fraud Attorney

Given the complexities and potential consequences of reporting Medicare fraud, consulting with a specialized Healthcare Fraud Attorney is a crucial step. Whether you’re a healthcare professional who’s noticed questionable billing practices or a concerned citizen aware of fraudulent activities, your actions can play a pivotal role in safeguarding the integrity of Medicare and protecting vital resources.

At Di Pietro Partners, our team of experienced Healthcare Fraud Attorneys, bolstered by healthcare professionals and former government administrators, is uniquely equipped to navigate the intricacies of Medicare fraud cases. With our extensive background in healthcare law and a proven track record of handling complex legal challenges, we’re committed to providing the highest level of representation and support.

We understand the courage it takes to step forward and the importance of ensuring your rights and interests are protected throughout the process. That’s why we offer a confidential, no-obligation consultation to discuss your case and explore your legal options. Our attorneys work on a contingency fee basis for whistleblower cases, meaning you won’t pay any legal fees unless we recover funds on your behalf. This approach aligns our success with yours and allows you to pursue justice without financial risk.

If you suspect Medicare fraud and are considering taking action, don’t navigate this challenging landscape alone. Contact Di Pietro Partners today to schedule your free consultation. Together, we can work to hold fraudulent parties accountable, recover stolen funds, and ensure Medicare remains a sustainable resource for those who depend on it.