ESTATE ADMINISTRATION

Estate administration refers to the distribution of assets after someone passes away. This process is also known as probate administration. Generally speaking, assets in the estate will pass on to a family member, loved one, or anyone else named as a beneficiary within the will of the deceased. This process is supervised through a specific court system (probate court) which ensures assets are correctly distributed to the named beneficiaries.

Each state has their own individual administration process. In Florida, almost every estate is required to enter probate. Having an attorney present throughout this process is not only recommended, but legally required in the State of Florida.

What Happens When There’s No Will?

In instances where someone passes away without a valid will, all of the property for the deceased individual will enter probate and undergo a specific process to determine who shall receive the estate. In legal terms, these assets are declared “intestate” which means the property is being held until beneficiaries are determined by the court.

This process is very in-depth and outlined in Chapter 732 of The Florida Statutes. Here are some main points on Florida’s intestate probate law:

– If the deceased individual (decedent) has no living children, grandchildren, or parents, then the spouse shall receive all assets from the estate.

– When the decedent has both a spouse, and living family members who are also family members of the spouse, then the spouse will receive all assets from the estate.

– In cases where the spouse has additional living family members that have no relation to the decedent, the spouse receives half of the estate while the family members of the spouse receives the other half.

Needless to say, legal counsel is required throughout this process, ideally, from an attorney specialized in probate.

Types of Estate Administration

Formal – Formal probate administration is the standard form of probate in Florida. This process begins as soon as someone passes away and executor of the will requests to be appointed as the personal representative for the estate. Once a personal representative is established, it’s required that beneficiaries named in the estate are given notice and provided the opportunity to raise any objections. This notice is called a “Notice of Administration.” There are other aspects involved in this process such as providing a “Notice to Creditors” in a local newspaper in the event that the decedent owed money prior to death. Formal probate takes place in the local circuit court of the county where the decedent lived at the time of death.

Summary – Summary Probate Administration is most common for cases where the estate is very small. If the estate is valued at $75,000, then it may be eligible. Other cases that warrant this form of administration involve a missing person that was declared dead. This is similar to formal administration; however, it’s an expired version of the process and settles much quicker. In order to qualify for this type of administration, it’s required that a Petition for Summary Administration is signed by a beneficiary of an estate and filed with the court.

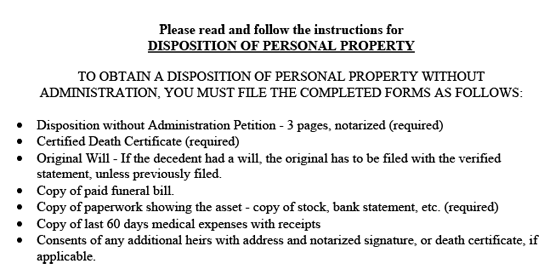

Disposition – In very rare cases, a probate hearing can be skipped entirely through a process called “Disposition Without Administration.” Simply put, this can only occur when the person who died left no property, or the property left is valued at less than the amount of final expenses after probate. Although the process is rare, this typically occurs when the decedent is in debt or owes a sum of money to creditors that is greater than the value of their assets.

Trust Administration

Trust administration also involves probate court; however, the laws involving the administration of trusts after someone passes away are far more involved than previously discussed aspects of estate administration. Below is a brief overview on trust administration in Florida.

Someone in charge of managing a trust is known as a trustee. On the other hand, individuals who receive benefits from the trust are called the beneficiaries. In Florida, trustees have many important duties and functions. For example, trustees are responsible for ensuring assets are handled in accordance with the wishes of the settlor. Trustees are also responsible for legal and financial aspects such as filing estate tax returns, and in some cases, paying the settlor’s debts.

In short, trustees have a legal responsibility to distribute assets within the trust to the named beneficiaries in accordance with the wishes of the deceased. It’s vital to work with an attorney that is experienced in probate and trusts to ensure the correct process is followed.