Whistleblower Medicaid Fraud Attorneys

Medicaid plays a critical role in providing healthcare services to individuals and families with limited income and resources. Funded jointly by the federal government and states, Medicaid’s extensive reach and substantial budget necessitate vigilant oversight to prevent and address fraud and abuse. The complexity and scale of Medicaid, involving significant expenditures, underscore the importance of whistleblower involvement in identifying fraudulent activities.

The medicaid fraud lawyers at Di Pietro Partners represent whistleblowers. We understand the courage it takes to step forward and the importance of ensuring your rights and interests are protected throughout the process. Our attorneys work on a contingency fee basis for whistleblower cases, meaning you won’t pay any legal fees unless we recover funds on your behalf. This approach aligns our success with yours and allows you to pursue justice without financial risk.

If you suspect medicaid fraud and are considering taking action, don’t navigate this challenging landscape alone. Contact our law firm for a free consultation today.

Our Medicaid Fraud Lawyers on TV

What is Medicaid Fraud/Abuse?

Medicaid fraud or Medicaid abuse involves illegal actions aimed at exploiting the jointly federally and state-funded healthcare program, Medicaid, for unauthorized financial advantage. Medicaid’s mission is to deliver necessary healthcare services to individuals and families with limited income, managing substantial financial allocations annually. The program’s expansive scope and complexity make vigilant oversight essential to prevent fraud, heavily relying on whistleblowers for detection and prevention efforts.

Medicaid fraud appears in various forms but is unified by the intent for illicit financial gain. Common manifestations of Medicaid fraud include:

Billing for Services Not Rendered: Healthcare providers claim compensation for procedures or services that were never administered to the patient. For example, a clinic might charge Medicaid for advanced diagnostic tests that were never actually conducted.

Upcoding: Providers deliberately inflate billing codes to higher-value services or procedures than those performed, seeking unjustly increased reimbursements from Medicaid.

Unnecessary Procedures: Charging Medicaid for medically unnecessary procedures merely to escalate billing totals represents fraud. This is alarmingly predatory towards defenseless groups, notably those without familial advocacy.

False Documentation: Encompasses dishonest practices like charging for non-performed procedures, non-visited patients, or fictitious home health care appointments.

The diligent identification and rectification of Medicaid fraud are vital for maintaining the integrity of the program. Whistleblowers are supported by legal frameworks and protections to report fraudulent actions, helping ensure Medicaid resources rightly aid those requiring medical services.

How to Report Medicaid Fraud

Reporting Medicaid fraud is essential for maintaining the integrity of healthcare services and ensuring that resources are distributed fairly. If you suspect fraudulent activities within the Medicaid system, it is important to take the following steps:

- Collect Evidence – Begin by gathering any information related to the suspected fraud. This may include billing records, communication exchanges, internal reports, or any other documents that could support your allegations. It’s important to obtain these documents while adhering to company policies and legal guidelines to avoid personal legal issues.

- Document Your Observations – Promptly write a detailed account of your observations and the specifics of the suspected fraud. Considering that investigations and legal processes may take years to conclude, this documentation will serve as an essential record, maintaining the integrity of your memory and observations.

- List Additional Relevant Documents – Identify any documents that could be related to your case but are not currently in your possession. This might encompass internal records, billing details, or known correspondence that you cannot directly access. Such a list will aid investigators and legal advisors in their efforts to thoroughly examine the case.

- Consult a Medicaid Fraud Lawyer – Seek the expertise of a law firm that specializes in Medicaid fraud. These attorneys are equipped to handle the nuances of healthcare fraud cases, offering crucial legal advice and representation. They will help in navigating the legal landscape, ensuring accurate filing of your report, and providing protection throughout the ordeal.

- Report to Government Agencies – Beyond consulting with a Medicaid fraud attorney, directly report your suspicions to the relevant government bodies. This can be achieved through the Office of the Inspector General (OIG) of the U.S. Department of Health and Human Services (HHS) or specific hotlines dedicated to Medicaid fraud.

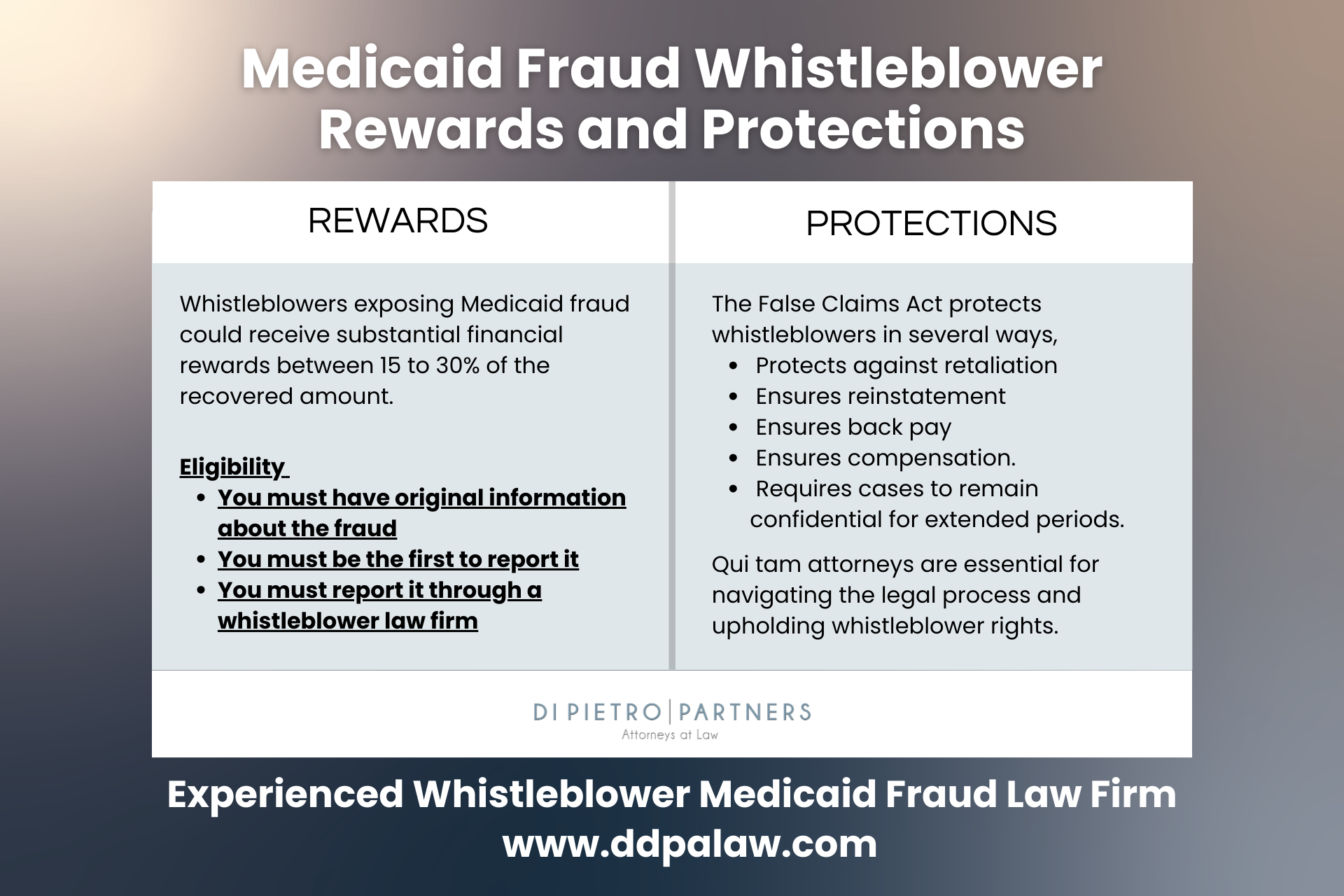

- Explore Whistleblower Safeguards – If you’re exposing fraud within your organization, be aware of the whistleblower protections provided by federal and state legislation. These protections are designed to shield individuals who report misconduct from retaliatory actions, safeguarding those who take a stand against wrongdoing.

By adhering to these procedures, you can significantly contribute to the fight against Medicaid fraud, fostering a more ethical and efficient healthcare system. Effective reporting is rooted in meticulous documentation and the pursuit of appropriate legal and professional advice.

Medicaid Fraud Whistleblower Rewards

Whistleblowers play a vital role in exposing medicaid fraud. Individuals with knowledge of fraud against the government are allowed to file lawsuits on behalf of the government.

It is vital to use an experienced medicaid fraud attorney to file this type of lawsuit. An individual that chooses to file this type of lawsuit is known as qui tam relators.

With a medicaid fraud attorney’s assistance, if you win this lawsuit you are entitled to up to 30% of recovered claims. However, if the government intervenes and becomes part of the case, you may be entitled to some compensation.

Of course, another point to consider is how do you know this illegal activity is happening? Has your employer forced you to be involved in any way? Considering these questions, if you know that Medicare or Medicaid fraud is happening where you work, contact a medicaid fraud attorney immediately.

How We Can Help

Our Medicaid fraud attorneys play a pivotal role in supporting whistleblowers to expose fraudulent practices within the healthcare system.

We start by conducting a thorough evaluation of the alleged fraud, applying our deep knowledge of healthcare law to assess the feasibility of initiating a whistleblower (qui tam) case under the False Claims Act. This initial review is crucial for ensuring the case is robust and fulfills the criteria necessary for whistleblower actions.

Following the decision to move forward, our attorneys adeptly navigate whistleblowers through the intricate process of filing a qui tam lawsuit. This step includes the careful preparation and presentation of comprehensive evidence to the government, detailed documentation of the fraudulent activities, and a clear demonstration of the fraud’s impact on the Medicaid program. Our objective is to furnish the government with a well-founded case that facilitates the successful prosecution and restitution of wrongly allocated funds.

Moreover, our involvement extends beyond the mere filing of the lawsuit; we maintain close cooperation with the government throughout the prosecution phase, ensuring a concerted effort to address and rectify the identified Medicaid fraud.

Why Choose Us

Choosing Di Pietro Partners for your Medicaid fraud case ensures you’re represented by a team adept at navigating the multifaceted realm of healthcare law. Our firm is fortified with healthcare lawyers, board-certified physicians, and former government administrators, each bringing decades of invaluable experience. This blend of expertise offers an unmatched level of insight and proficiency to every case we undertake.

David Di Pietro, with his extensive background as a healthcare and medical malpractice lawyer, has adeptly guided clients through a wide range of intricate healthcare issues, including misdiagnosis and medication errors. His broad trial experience, coupled with his authoritative voice on significant legal matters like the Purdue Pharma Opioid Lawsuit on national television, highlights his determined pursuit of justice for his clients.

Adding a crucial medical viewpoint to our team, Dr. Tiffany Di Pietro serves as the medical advisor. Her achievements as the youngest graduate from Nova Southeastern University’s College of Osteopathic Medicine and her quadruple board certification across several medical fields provide a critical edge in analyzing medical records and evidence. Her frequent appearances as a medical expert on national news platforms further affirm her esteemed standing in the medical field.

Opting for Di Pietro Partners means enlisting a powerful coalition of legal and medical experts dedicated to securing justice and favorable outcomes for their clients. Our comprehensive strategy in tackling Medicaid fraud cases merges legal expertise with medical acumen, distinguishing us as a leading choice for those facing complex healthcare legal challenges.

Types of Medicaid Fraud

- Billing for Services Not Rendered: A typical example could involve a mental health clinic that only provides basic counseling sessions but submits Medicaid claims for comprehensive psychiatric evaluations and therapeutic procedures that never occurred. This fraudulent billing inflates reimbursement, exploiting funds meant for legitimate patient care.

- Upcoding: Healthcare providers may deliberately use billing codes for more complex or expensive services than those actually delivered. This practice, known as upcoding, inflates the payment from Medicaid under false pretenses, constituting a direct form of fraud.

- Unnecessary Procedures: Billing Medicaid for medical procedures that are not clinically required is another form of fraud. It not only drains resources from the system but also exposes patients to unnecessary risk. Employees or insiders who notice such practices are encouraged to report them, as these acts often target vulnerable populations without adequate oversight.

- False Documentation: Creating fictitious records or claiming reimbursement for patient visits that never happened falls under this type of fraud. Similarly, fabricating documentation for home health services that were never provided abuses the trust and resources of the Medicaid program.

- Kickbacks and Referrals: Offering or accepting financial incentives in exchange for the referral of Medicaid patients compromises the integrity of healthcare decisions and violates federal and state laws designed to prevent such conflicts of interest.

- Phantom Billing: This involves charging Medicaid for more expensive services or equipment than those actually provided, or billing multiple times for the same service, thus unlawfully increasing reimbursement amounts.

- Upcoding of Patient Diagnosis: Exaggerating a patient’s condition to justify unnecessary tests or treatments that result in higher payments from Medicaid manipulates the system for financial gain.

- Prescription Fraud: Includes prescribing unnecessary medications or engaging in schemes with pharmacies to bill Medicaid for medications not required by patients, contributing to the opioid crisis through pill mill operations.

- Identity Theft: Utilizing someone else’s Medicaid information to receive healthcare services or to falsely bill for services leverages the identity of legitimate beneficiaries for fraudulent purposes.

- Equipment Fraud: Involves claims for medical supplies, equipment, or prosthetics that were never provided to the patient or were not medically necessary, exploiting Medicaid’s provision for durable medical equipment.

Federal Medicaid Fraud Laws

Federal Medicaid fraud laws serve to safeguard the Medicaid program’s integrity by imposing penalties on fraudulent activities designed to manipulate or misappropriate federal and state healthcare funds. These regulations span a broad spectrum of statutes, targeting different forms of fraud and misconduct within the Medicaid system. Below is a summary of significant federal laws pertaining to Medicaid fraud:

False Claims Act (FCA): This legislation forbids the intentional submission of false claims to receive federal payments. The FCA subjects individuals and entities to liability if they submit fraudulent claims to Medicaid. Additionally, it features whistleblower provisions that empower private individuals to initiate lawsuits on the government’s behalf and potentially share in any restitution.

Anti-Kickback Statute (AKS): The AKS criminalizes the act of knowingly and willingly offering, paying, soliciting, or accepting any remuneration to induce referrals for services or items reimbursed by federally funded programs, including Medicaid. Its objective is to guarantee that medical judgments are made in the patient’s best interest, free from undue financial influences.

Physician Self-Referral Law (Stark Law): Specifically addressing Medicaid and Medicare fraud, the Stark Law bars physicians from referring patients to receive designated health services payable by Medicaid or Medicare from any entity where the physician or their immediate family member has a financial interest, barring specific exemptions.

Health Care Fraud Statute: This statute criminalizes the deliberate execution or attempt to execute a scheme to defraud any healthcare benefit program or to secure, by fraudulent means, any money or property under the control of any healthcare benefit program.

Violations of these laws can result in severe penalties, including fines, restitution, and imprisonment. The federal government, through various agencies such as the Department of Health and Human Services’ Office of Inspector General (HHS-OIG) and the Department of Justice (DOJ), enforces these laws rigorously. These agencies work together to investigate and prosecute medicaid fraud cases, recover stolen funds, and implement measures to prevent future fraud.

Medicaid Drug Rebate Program

The Medicaid Drug Rebate Program represents a complex yet critical mechanism to ensure that Medicaid, a crucial healthcare program for low-income individuals, receives pharmaceuticals at fair prices. This system obligates drug manufacturers to report the Average Manufacturer Price (AMP) and the Best Price for every dosage form and strength of prescription drugs supplied to Medicaid beneficiaries. These prices, kept confidential, form the basis for calculating the drugmakers’ rebate obligations.

The Centers for Medicare & Medicaid Services (CMS) utilize the submitted price data to calculate a unit rebate amount (URA) for each covered drug. Subsequently, state agencies issue quarterly invoices to drug manufacturers, leveraging the URA and their records of dispensed units to ascertain the owed rebate amounts. Manufacturers are then required to settle these rebates within 38 days from invoice receipt to avoid accruing interest charges.

To streamline the calculation of rebate amounts, drugs are categorized into three distinct types:

- Innovator Multiple Source Drug: This category encompasses drugs approved under various application processes by the FDA and may include drugs marketed under a New Drug Application (NDA) by cross-licensed producers or distributors.

- Single Source Drug: Defined as a drug produced or distributed under an original FDA-approved NDA, including drugs approved under PLA, ELA, or ADA.

- Non-Innovator Multiple Source Drug: This refers to multiple source drugs that are not classified as innovator multiple source drugs, typically generic drugs.

The rebate formula for drugs incorporates a basic rebate and, for brand name drugs, an additional rebate to account for price increases surpassing inflation rates. The formula ensures brand name drugs, which almost invariably owe additional rebates, contribute significantly to Medicaid’s cost-saving measures. In contrast, generic drugs attract a base rate rebate of 11% of the AMP without the additional rebate, underscoring the economic advantage of generic drug utilization in Medicaid.

Our Medicaid Fraud Lawyers are adept at navigating the intricacies of the Medicaid Drug Rebate Program and are ready to assist in identifying and addressing potential fraud within this system. For those seeking clarity on potential fraud or abuse, we offer comprehensive and confidential case reviews to explore legal options and ensure the integrity of Medicaid expenditures.

Other Types of Healthcare Fraud

Besides Medicaid fraud, the healthcare industry faces various other types of fraud that can significantly impact both the financial integrity of healthcare systems and patient care. These include:

Medicare Fraud – Medicare fraud encompasses illicit actions targeting the Medicare program, a federal initiative offering healthcare coverage to individuals over the age of 65, as well as to certain younger people with disabilities. Such fraudulent practices undermine the integrity and financial stability of Medicare by including deceitful billing for unprovided services, upcoding to inflate reimbursement rates, and charging for medically unnecessary procedures. These activities not only drain valuable resources but also compromise the quality of care available to Medicare beneficiaries, highlighting the critical need for diligent oversight and robust anti-fraud measures to protect this essential healthcare program.

Private Insurance Fraud – This type of fraud involves submitting false or exaggerated claims to private health insurance companies. Tactics include billing for services not provided, double-billing both the insurance and the patient, and performing unnecessary procedures to increase billing.

Prescription Drug Fraud – Prescription drug fraud can involve various schemes, including “doctor shopping” to obtain multiple prescriptions, forging or altering prescriptions, and illegal distribution and sale of prescription medications. Pharmaceutical companies may also engage in fraud through off-label marketing or manipulating prices.

Kickbacks and Referral Schemes – Illegal kickbacks involve receiving or paying something of value in exchange for referrals for services that will be billed to a healthcare program. The Anti-Kickback Statute specifically targets this type of fraud to ensure medical decisions are based on patient needs rather than financial incentives.

Provider Identity Theft – Fraudsters may use a healthcare provider’s identity to submit false claims for services never rendered or to obtain controlled substances for illegal distribution. This not only defrauds healthcare programs but also damages the reputation of the providers whose identities are stolen.

Upcoding and Unbundling – Upcoding involves billing for a more expensive service than was actually provided, while unbundling refers to billing each step of a procedure as if it were a separate procedure to increase the total bill. Both practices are illegal and inflate healthcare costs fraudulently.

False or Exaggerated Claims for Disability Benefits – Submitting false or exaggerated claims to obtain disability benefits from government or private insurers constitutes fraud. This can include misrepresenting one’s health condition, employment status, or income.

Addressing these types of healthcare fraud requires vigilant monitoring, strict enforcement of laws, and public awareness. Healthcare fraud not only drains resources but also compromises patient care and increases costs for everyone in the healthcare system.

Medicaid Fraud FAQ

Q. What happens when you report Medicaid fraud?

Once you report Medicaid fraud, the report is reviewed by the relevant agency, such as the Office of Inspector General (OIG) or the Centers for Medicare & Medicaid Services (CMS), to determine the necessity of an investigation. If an investigation is deemed necessary, it proceeds confidentially. The specific circumstances of the case will dictate whether you’re contacted for additional information. Outcomes of such investigations can vary, from the recovery of misused funds and imposition of penalties on the perpetrators to potential criminal prosecution in severe cases.

Q. Where do you report Medicaid fraud?

Medicaid fraud should be reported to official bodies such as the Office of Inspector General (OIG), the Centers for Medicare & Medicaid Services (CMS), or the Medicaid Fraud Control Unit (MFCU) of your state. Additionally, the Senior Medicare Patrol (SMP) can offer assistance in fraud reporting and provide valuable resources for Medicaid beneficiaries. Considering the complexity of healthcare fraud cases, involving a specialized Medicaid fraud law firm can greatly benefit the reporting process. These law firms specialize in healthcare law and ensure that reports are comprehensively documented and accurately filed, emphasizing the gravity of the fraud allegations and aiding in the efficient processing and investigation of the case.

Q. How do you report Medicaid fraud anonymously?

If you wish to report Medicaid fraud anonymously, it’s recommended to proceed through a reputable law firm. This approach ensures your legal rights are safeguarded through attorney-client privilege. Although offering your contact details can aid the investigation, it’s not obligatory, allowing for the submission and processing of your report without revealing your identity.

Q. How long does a Medicaid fraud investigation take

The duration of a Medicaid fraud investigation can vary significantly, depending on the complexity of the case, the amount of evidence to be gathered and analyzed, and the level of cooperation from all parties involved. Typically, an investigation might take anywhere from several months to a few years to complete. Initial inquiries and data collection can be time-consuming, and if the investigation leads to legal proceedings, such as trials or settlement negotiations, the timeline can extend further. The specific time frame also depends on the workload of the investigating agency and the efficiency of legal processes in place.

Q. What is the cost of a Medicaid fraud lawyer?

The cost of hiring a Medicaid fraud lawyer can vary widely based on several factors, including the complexity of the case, the lawyer’s experience, and the law firm’s billing practices. The Medicaid fraud attorneys at Di Pietro Partners work on a contingency fee basis on whistleblower (qui tam) cases under the False Claims Act. This means the lawyer only gets paid if you win the case or reach a settlement, taking a percentage of the recovered funds as their fee. This percentage can vary but typically ranges from 20% to 40% of the recovery.

Talk to a Healthcare Fraud Attorney

Given the complexities and potential consequences of reporting medicaid fraud, consulting with a specialized medicaid fraud attorney is a crucial step. Whether you’re a healthcare professional who’s noticed questionable billing practices or a concerned citizen aware of fraudulent activities, your actions can play a pivotal role in safeguarding the integrity of medicaid and protecting vital resources.

At Di Pietro Partners, our team of experienced medicaid fraud attorneys, bolstered by healthcare professionals and former government administrators, is uniquely equipped to navigate the intricacies of medicaid fraud cases. With our extensive background in healthcare law and a proven track record of handling complex legal challenges, we’re committed to providing the highest level of representation and support.

We understand the courage it takes to step forward and the importance of ensuring your rights and interests are protected throughout the process. That’s why we offer a confidential, no-obligation consultation to discuss your case and explore your legal options. Our attorneys work on a contingency fee basis for whistleblower cases, meaning you won’t pay any legal fees unless we recover funds on your behalf. This approach aligns our success with yours and allows you to pursue justice without financial risk.

If you suspect medicaid fraud and are considering taking action, don’t navigate this challenging landscape alone. Contact Di Pietro Partners today to schedule your free consultation. Together, we can work to hold fraudulent parties accountable, recover stolen funds, and ensure Medicaid remains a sustainable resource for those who depend on it.