Mergers and Acquisitions Lawyer (M&A Lawyer)

At Di Pietro Partners, our seasoned team of mergers and acquisitions lawyers stands at the forefront of facilitating complex business transactions with unparalleled expertise and precision. Our profound grasp of the multifaceted legal terrain governing mergers and acquisitions empowers us to offer strategic guidance tailored to propel your business objectives forward.

Navigating the intricate process of merging with or acquiring another company demands a keen understanding of legal, financial, and strategic factors. Whether you’re eyeing an opportunity to merge with a complementary business, seeking to acquire a competitor to bolster your market position, or contemplating a strategic divestiture, our M&A lawyers are equipped to manage the nuances of each transaction.

We understand the transformative impact these transactions can have on your business. That’s why our mergers and acquisitions attorneys are dedicated to providing legal services that not only address the unique challenges of each deal but also harness the opportunities to drive growth and innovation. From due diligence and negotiation to structuring deals and navigating regulatory approvals, our comprehensive support is designed to achieve your strategic goals while minimizing risk.

How Our M&A Attorneys Can Help

The M&A attorneys at Di Pietro Partners are crucial allies in navigating the complexities of mergers and acquisitions, offering strategic guidance tailored to your business goals. From initial strategic planning and thorough due diligence to the meticulous structuring of deals and skilled negotiation, we ensure that every aspect of your transaction aligns with optimal outcomes. Our comprehensive approach covers regulatory compliance, securing necessary approvals, and facilitating a smooth closing and effective post-closing integration.

We pride ourselves on not only mitigating risks but also in crafting innovative deal structures that maximize strategic benefits and financial efficiencies. As your partners, we are committed to advocating for your interests at every stage, employing our extensive legal and business acumen to navigate the nuances of each transaction.

Florida Mergers and Acquisition Laws

Navigating Florida’s mergers and acquisitions (M&A) landscape can seem daunting at first glance. The state’s laws provide a structured framework to ensure these complex transactions are conducted smoothly, with clarity and fairness for all parties involved.

In Florida, M&A laws are primarily governed by the Florida Business Corporation Act. This legislation outlines the procedures and requirements for successfully executing mergers and acquisitions in the state. The Act covers various types of business entities, including corporations, limited liability companies (LLCs), and partnerships, providing a comprehensive legal basis for M&A activities.

The Role of Due Diligence – Due diligence is a critical step in the M&A process, where potential buyers assess the target company’s assets, liabilities, and overall financial health. Florida law encourages thorough due diligence to protect all parties’ interests and ensure informed decision-making. This process often involves reviewing financial statements, contracts, employee information, and compliance with laws.

Merger Procedures – For a merger to take place in Florida, the boards of directors from the merging companies must first approve a plan of merger, outlining the terms and conditions of the merger, the manner of converting shares, and the corporate structure of the merged entity. This plan must then be approved by a vote of the shareholders. In certain cases, especially when one company wholly owns another, shareholder approval may not be necessary.

Acquisition Strategies – Acquisitions in Florida can be structured in various ways, including asset purchases, where a company buys another company’s assets directly, and stock purchases, where a company buys another company’s stock to gain control. The choice of strategy affects the legal implications, tax considerations, and the need for approval from shareholders or directors.

Regulatory Compliance – Companies engaging in M&A activities must ensure compliance with both state and federal regulations. This includes adhering to antitrust laws, securities regulations, and industry-specific legal requirements. The Florida Attorney General’s office may review transactions for antitrust concerns, ensuring that mergers or acquisitions don’t unfairly limit competition.

Protection for Minority Shareholders – Florida M&A laws provide protections for minority shareholders, including the right to dissent and receive fair value for their shares in certain merger scenarios. These protections ensure that the interests of smaller shareholders are considered in the transaction process.

Closing and Integration – After receiving all necessary approvals and fulfilling legal requirements, the transaction can close. Following the closure, the process of integrating the acquired company begins, involving the consolidation of operations, cultures, and strategies to achieve the desired synergies.

Buying a Business in Florida

Embarking on the journey to purchase a business in Florida is made significantly smoother with the expertise of the M&A lawyers at Di Pietro Partners. Our approach begins with a deep dive into your business objectives to identify opportunities that best match your vision. The cornerstone of our service is conducting exhaustive due diligence, where we meticulously examine the financial health, legal standings, and operational frameworks of potential acquisitions. This rigorous analysis ensures you’re informed about every facet of the business you intend to buy.

With Di Pietro Partners, navigating Florida’s regulatory complexities becomes less daunting. Our negotiation strategies are crafted from a foundation of comprehensive due diligence, aiming to secure terms that not only reflect the business’s value but also align with your future growth plans. From drafting the purchase agreement to overseeing the seamless transition of ownership, our team is dedicated to transforming your entrepreneurial aspirations into reality, supporting you at every step of acquiring a business in Florida’s vibrant market.

Selling a Business in Florida

When the time comes to sell your business in Florida, the M&A lawyers at Di Pietro Partners offer unmatched guidance through the strategic, legal, and financial aspects of the sale process. We start by preparing your business for the market, focusing on optimizing its appeal to prospective buyers. Our team assists in determining an accurate valuation, ensuring you’re positioned to receive the best possible offer. Leveraging our extensive network, we discreetly market your business, attracting qualified buyers while safeguarding its confidentiality.

Negotiating the sale is where our expertise truly shines. The M&A lawyers at Di Pietro Partners excel in securing favorable terms that honor the legacy of your business while complying with all of Florida’s legal requirements. Finalizing the sale involves meticulous preparation of the sales agreement and a carefully managed closing process. With Di Pietro Partners, selling your business becomes a strategic move towards your next venture, executed with professionalism and an unwavering commitment to your success.

Healthcare Mergers and Acquisitions

The sale of a medical practice or healthcare business is a complex process with many legal aspects. For example, there are specific types of contracts required for these transactions. These contracts may include: purchase agreements, lease agreements for offices, employment contracts for the medical staff, etc.

Additionally, certain state and federal regulations exist such as licensing for medical facilities (particularly surgical centers). As a result, obtaining legal counsel to oversee the purchase or sale of a medical practice is a critical step in this process.

One unique aspect of our law firm is that we have a vast amount of legal experience in both business law and healthcare. In other words, we have the necessary expertise to properly assist clients with the purchase or sale of a private medical practice or healthcare business in Florida.

Florida Mergers & Acquisitions Forms

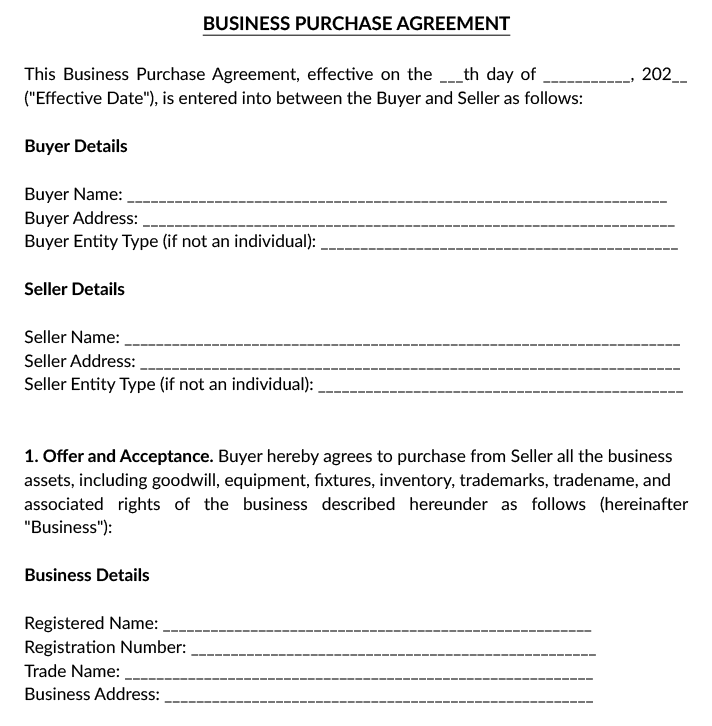

In Florida, mergers and acquisitions (M&A) transactions involve a series of documents that are critical for the due diligence, negotiation, and finalization phases of the deal. These documents serve to ensure the transaction is conducted legally, efficiently, and to the satisfaction of all parties involved. Here are key documents typically relevant to Florida M&A transactions:

Letter of Intent (LOI): An initial document outlining the preliminary understanding between parties interested in proceeding with an M&A transaction. While not always binding, it sets the stage for negotiations.

Confidentiality Agreement (NDA): Essential for protecting sensitive information shared during the M&A process. It ensures that data related to the businesses involved are not disclosed to third parties without permission.

Due Diligence Documents: These encompass a wide range of financial, legal, and operational records reviewed by the buyer to assess the target company’s value and identify potential risks. They include financial statements, contracts, employee records, intellectual property documents, and compliance records.

Acquisition Agreement: The primary legal document in an M&A transaction, detailing the terms and conditions of the sale. In Florida, this could be an Asset Purchase Agreement, a Stock Purchase Agreement, or a Merger Agreement, depending on the structure of the deal.

Non-Compete Agreements: Often part of M&A deals to prevent the seller from starting a competing business within a certain timeframe and geographical area.

Employment Agreements: New or amended agreements for key employees who will continue with the company post-transaction.

Regulatory Approval Documents: Depending on the industry and size of the transaction, regulatory approvals may be required. Documentation for submissions to relevant authorities, including the Florida Department of Financial Services or the Federal Trade Commission, might be necessary.

Escrow Agreements: Used to hold a portion of the purchase price in escrow to cover potential post-closing adjustments or indemnification claims.

Closing Documents: Encompass various legal documents executed at the closing of the M&A transaction, such as bills of sale, assignments, and director or shareholder resolutions.

Post-Closing Adjustment Agreements: These agreements detail the mechanisms for adjusting the purchase price after closing based on actual working capital, debt levels, and other factors.

Integration Plans: While not always formalized, a document outlining the plan for integrating the operations, cultures, and systems of the merging entities can be crucial for the success of the merger or acquisition.

Preparing and reviewing these documents requires careful legal and financial scrutiny. Mergers and acquisitions lawyers play a vital role in drafting, reviewing, and negotiating these documents to align with the strategic objectives of the transaction while ensuring compliance with Florida laws and regulations.

Talk to a Mergers and Acquisitions Lawyer Today

The mergers and acquisitions attorneys at Di Pietro Partners bring a wealth of experience to navigating the complex landscape faced by businesses during significant transitions. With a rich history of advising Florida’s rapidly growing companies, our team possesses an in-depth understanding of the critical need for comprehensive legal services, prompt response, and flexible fee structures tailored to the dynamic environment of mergers and acquisitions.

For businesses contemplating a merger or acquisition, our firm offers strategic counsel on conducting due diligence, structuring transactions to optimize financial and operational outcomes, and navigating the intricacies of state and federal regulations. We understand the importance of seamless integration and alignment in mergers and acquisitions, providing guidance on initial agreements, negotiations with stakeholders, and securing the necessary approvals to advance your business objectives.

As your business evolves, whether through expansion, strategic alliances, or planning for sale, Di Pietro Partners is equipped to advise on a wide range of related considerations, including financing options, intellectual property protection, corporate restructuring, and effective dispute resolution strategies. Our attorneys are committed to not just facilitating transactions but ensuring that your company is positioned for sustained growth and success in the aftermath of a merger or acquisition.

In every phase of your business’s lifecycle, from contemplating your first acquisition to strategizing your exit, the M&A lawyers at Di Pietro Partners are your dedicated partners, ensuring that each decision is informed, strategic, and aligned with your long-term vision.