FLORIDA PROBATE ATTORNEY

After a person passes away, property is often passed along to family members of the deceased. Unfortunately, certain disputes may arise even when the decedent has a solid estate plan in place. For example, issues can occur regarding the actions of the personal representative or the trustee. Further, the prior mental state of the deceased may be called into question. Also, issues may be present with creditors, beneficiaries, etc. There are other potential unforeseen consequences and laws regarding probate, some of which are specific to the State of Florida. As a result, you want an experienced Florida probate attorney protecting your interests throughout this process.

Regardless of the complexity of a case, the probate attorneys Di Pietro Partners are well equipped in guiding you through this process. If you or someone you know needs help with probate in Florida, contact our lawyers for a free case evaluation. 1.800.712.8462.

Probate Attorney David Di Pietro on National TV

Free Guide On Probating a Will in Florida

Probate Overview

Probate is a court supervised process used to determine who receives assets of a deceased individual.

Once a person dies, wills are required to go through probate court. Probate is necessary in the administration of assets to a decedent’s beneficiaries outlined within the will. This process is required to prove the validity of the will and ensure assets are properly distributed to the correct beneficiaries.

There are two primary forms of probate in Florida:

1. Formal Administration

Formal Administration refers to the “standard” probate process used for most estates in the State of Florida after someone passes away. Formal probate is used when the total value of the estate is valued at $75,000 or more.

2. Summary Administration

Summary Administration is a more “expedited” version of probate and is only available for estates that are valued at less than $75,000.

The attorneys at our law firm are very experienced with both formal and summary administration all throughout the State of Florida. We can make this process as simple, straightforward, and as painless as possible.

How A Probate Attorney Can Help

An attorney’s assistance in the probate process is vital. For instance, an attorney understands how best to “marshal” the assets, i.e., determine which assets are indeed part of the estate; how to properly file an Inventory and Appraisal of the assets; when, and in what manner, to pay the estate’s taxes, debts, and remaining liabilities; and how best to distribute those assets remaining in the estate’s inventory after all other processes have been concluded.

Why Hire Us?

Our law firm has decades of experience helping clients navigate Florida’s probate process. We have a firm understanding of each step in this process and are able to provide you with the most appropriate solution based on your individual needs.

When you work with a probate attorney at Di Pietro Partners, we give our full attention to your case. Our law firm is large enough to take on complex cases yet small enough to provide a personalized service.

Probate cases we handle range from simple administration and distribution of assets among family members to complex estate litigation members such as contested wills or legal disputes involving trusts. Regardless of your issue, your estate is in good hands with our firm.

We routinely handle the following probate matters all throughout the State of Florida:

Florida Probate Process

According to Florida law, after an individual dies, all assets of the decedent must be transferred out of his or her name. Assets that are jointly owned, have a beneficiary designation or that are payable on death, do not have to go through probate. However, all other assets that are titled solely in the decedent’s name must go through this legal process. This can often take between six (6) to twelve (12) months.

This section will provide the basic steps involved with Florida probate. If you’d like a more in-depth summary of this process, here’s an article we wrote on Florida’s probate laws.

1. Filing The Will

The person who’s responsible for the will needs to file the legal document with the Florida Circuit Court within the county which the testor resides in at the time of death. For example, if someone passes away in Fort Lauderdale, they will need to file the will within the Broward County Probate Court.

2. Petition for Administration

Filing a Petition for Administration is the next step involved in this process. This is basically a formal request to probate a will.

3. Personal Representative

The next step is the appointment of a personal representative. This individual is responsible for gathering and distributing assets of the individual who passed away. You can read more about appointing personal representatives and their duties in this article.

4. Determine Validity of a Will

The court must check to ensure a will was executed in accordance with Florida law. That is, the will must be signed, witnessed, notarized, and filed properly and without undue influence.

5. Accounting

The personal representative must account for all assets within the estate. This includes listing all disbursements and providing receipts for necessary transactions. After all assets in the estate are accounted for, notice will be given to all interested parties (i.e. creidors, etc). These interested parties will have 30 days to file a dispute. After these 30 days, the probate court will hold a final hearing to authorize this accounting.

6. Closing

After accounting has concluded, the personal representative will file a final petition for discharge of the estate. Once all assets are distributed and all debts have been taken care of. The court enters an order to finally close the estate.

Dying Without a Will in Florida

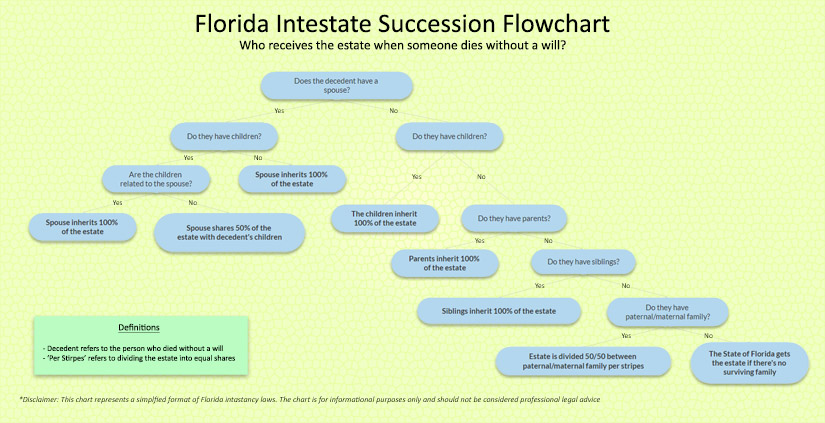

When someone dies without a valid will, their assets are declared intestate. It’s important to note that “intestate” does not mean that the property now belongs to the State. In fact, Florida has a specific process in determining who receives the decedent’s assets in the absence of a valid will. Here’s a simplified flowchart showing who receives assets when someone passes away without a will in Florida.

- When the decedent has a surviving spouse and has no living children, grandchildren, parents, etc, then the spouse shall receive the entire estate.

- If the decedent has a spouse and also has one or more living family members who are family members of the spouse (i.e children), the spouse shall receive the entire estate.

- If the spouse has additional living immediate family members that are not immediate family of the deceased individual, the spouse shall receive one-half of the estate with the other half going to the spouse’s descendants.

- In cases where the decedent was not married at the time of their passing, the immediate family members will receive the entire estate. The assets will then be divided in accordance with Florida law.

- If the deceased person was not married and also has no living immediate family members, the inheritance will pass to surviving parents of the decedent.

- In cases where someone dies without any surviving close family members, spouses, or relatives, the State of Florida will search for more remote heirs in accordance with intestate law.

The full process can be found in Chapter 732 of The Florida Statutes. This process is very in-depth and often causes confusion/disagreements among beneficiaries. As a result, it’s vital to work with a Florida probate attorney that’s experienced with issues involving intestate succession.

Probate and Trusts

Legal aspects involving trusts are handled through probate court. This includes the administration of a trust (ensuring assets go to named beneficiaries) as well as litigation matters such as disputes among beneficiaries.

Trustees are responsible for ensuring assets are handled in accordance with the wishes of the settlor. In fact, trustees have certain fiduciary duties required by Florida law.

Duties and obligations by a trustee include:

- Accounting (providing annual reports to each beneficiary)

- Tax compliance

- Duty of good faith

- Duty of impartiality

- Paying the settlor’s debts

- Filing estate tax returns (for larger estates)

In short, trustee’s are responsible for handling the trust honestly in accordance with the wishes of the settlor and keeping detailed accounting of the assets while following state and federal laws (i.e. taxes).

Our probate and trust lawyers are experts in assisting with each of these duties and ensuring the correct legal processes are followed.

Probate Litigation

After a person passes away, property is often passed along to family members of the deceased. Unfortunately, certain disputes may arise even when the decedent has a solid estate plan in place. For example, issues can occur regarding the actions of the personal representative or the trustee. Further, the prior mental state of the deceased may be called into question. Also, issues may be present with creditors, beneficiaries, etc.

These legal issues ultimately may cause an estate to be formally challenged in court and enter into what’s commonly referred to as probate or estate litigation.

Here’s a list of some common legal issues in probate court.

- Contested Wills

- Disputes Over Trusts

- Issues With Personal Representatives

- Disputes Over Legal Guardianship

- Creditor Disputes

- Removal of a Beneficiary From an Estate

Our law firm has extensive trial experience, particularly, in matters related to probate, estate and trust litigation. We represent beneficiaries, personal representatives, trustees, creditors, or other interested persons throughout Florida.

Common Probate Questions

Do All Assets Go Through Probate?

After an individual dies, all assets of the decedent must be transferred out of his or her name. Assets that are jointly owned, have a beneficiary designation or that are payable on death, do not have to go through probate. However, all other assets that are titled solely in the decedent’s name must go through the probate legal process.

How Long Does Probate Take?

Three months (90 days) is the general length of time it takes for an estate to go through probate in Florida. This is the typical length of time because the personal representative is legally required to provide creditors 90 days dispute the estate after notice is provided to the creditors through local newspapers.

This length of time (90 days) is assuming the estate is going through formal probate and that there aren’t any complications during the probate process. Certain factors can influence this length of time dramatically. These factors may include:

- High value estates (larger estates may require tax filings)

- Challenges to the estate (contested wills, creditor issues, etc.)

- Informal Probate (estates valued less than $20,000)

In these cases, the length of time it takes for an estate to go through probate may be increased or decreased depending on the circumstances.

What If Someone Dies Without a Will?

When someone dies without a valid will, assets/property are considered “intestate” and the probate process becomes more lengthy and complex. If someone dies intestate the State of Florida will try and determine who receives assets based on relation to the deceased individual. In other words, these assets will generally go to a spouse, or family member.

Do I Need a Lawyer?

Yes, the State of Florida requires that an attorney is present throughout the probate process with only a very select few exceptions. These exceptions involve someone dying without any assets or assets that are valued at less than the total cost of probate.

Probate Lawyer Certifications & Expertise

AV Preeminent® Rated – Di Pietro Partners is AV Preeminent® Rated for numerous areas of practice including probate litigation, probate administration, trust litigation, and more. AV Preeminent is a peer reviewed accreditation sponsored by Martindale. The accreditation is determined based on several factors including legal knowledge, analytical capability, judgement, communication, and legal expertise.

Best Probate Lawyers in Plantation – Di Pietro Partners was featured on Expertise.com for 2021 Best Probate Lawyers in Plantation on professionalism, reputation, and many other factors determined by a strict review process.

Fort Lauderdale Probate Law Firm

The primary office of Di Pietro Partners is located in Fort Lauderdale, FL. We also have satellite offices in Orlando, Miami, West Palm Beach, Fort Myers, Tampa, and Jacksonville. We handle probate cases anywhere in Florida. This includes working remotely with out-of-state clients.

Regardless of the complexity of your case, the lawyers at Di Pietro Partners are well equipped in helping you to navigate your legal issue. For questions or concerns related to probate in Florida, contact us for a free consultation.