The False Claims Act (FCA) exists to prevent fraud and protect taxpayers. Numerous state and federal laws aim to combat abuse within the United States medical system. Unfortunately, some individuals still break these laws for financial gain. Thankfully, honest individuals step forward to expose such criminal activity within the healthcare field. These courageous individuals are known as whistleblowers. If you suspect healthcare fraud in California or elsewhere, contact an experienced healthcare fraud attorney to ensure your rights are protected.

Healthcare Fraud Examples

Healthcare fraud and abuse can occur in any medical facility or supply center. Examples include:

- Receiving kickbacks, bribes, or cash for referrals, medical services, or supplies

- Billing for services never provided

- Submitting false information to Medicare or Medicaid

- Performing unnecessary medical procedures

- Overprescribing drugs

- Overcharging for procedures, medications, or equipment

- Modifying medical coding to obtain higher reimbursements

California Claims Act Laws

Fraudulent medical claims in California are governed by both federal and state laws, ensuring that individuals or entities that submit false claims for government-funded healthcare programs are held accountable.

Federal Law

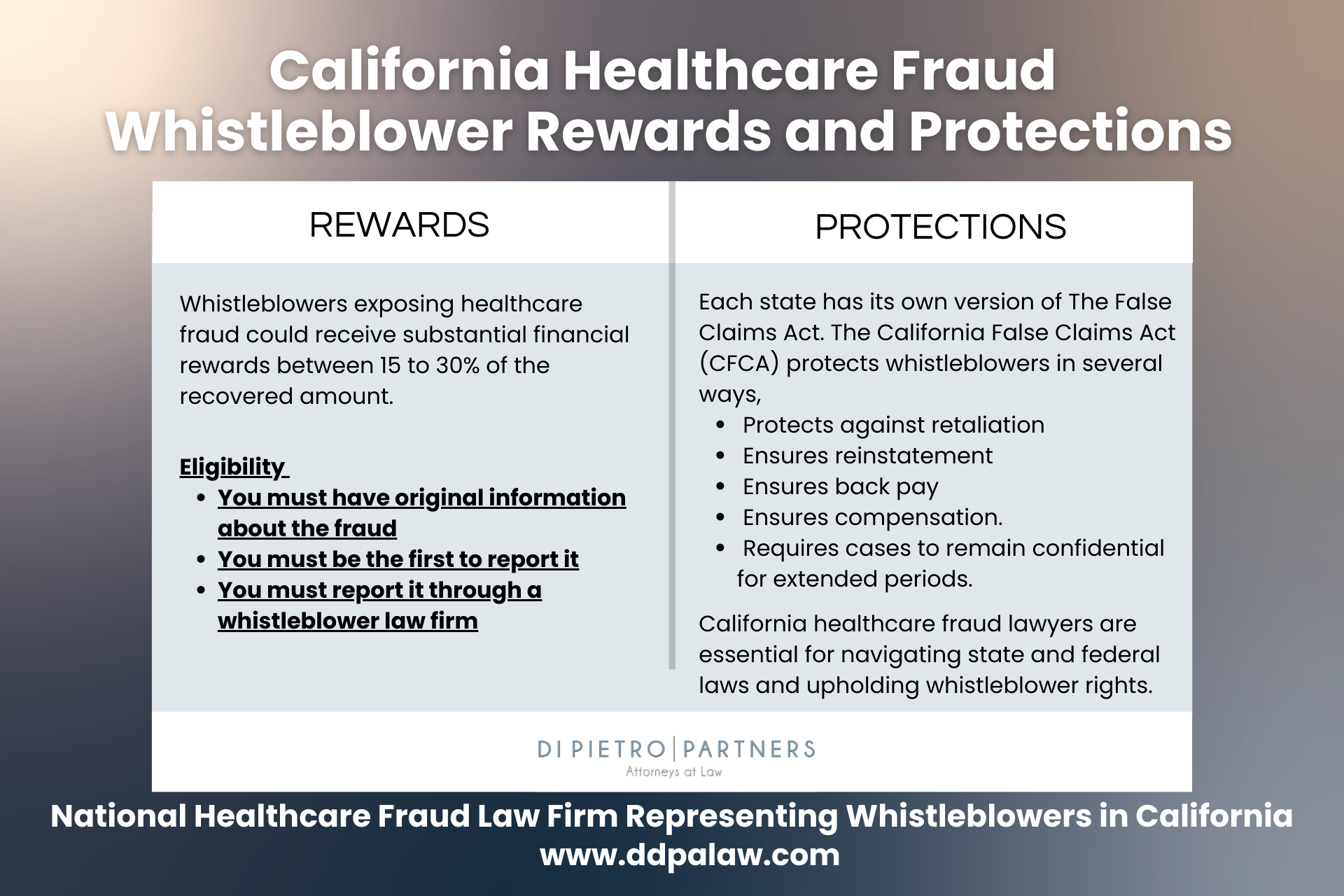

The U.S. False Claims Act (31 U.S.C. §§ 3729-3733) addresses fraud against federally funded healthcare programs, including Medicare and Medicaid. Under this law, private citizens who have knowledge of fraudulent claims can file a lawsuit on behalf of the U.S. Government through the qui tam provision. These whistleblowers may be eligible to receive a percentage of the recovered funds as a reward. If the government intervenes in the case, the whistleblower’s reward may be lower but can still be significant. Due to the complexities involved, consulting an experienced healthcare fraud attorney is essential.

California State Law

The California False Claims Act (CFCA) (Cal. Gov. Code §§ 12650-12656) allows the state to take legal action against individuals or entities that knowingly submit false claims for payment from California’s government programs, including Medi-Cal, the state’s Medicaid program. Similar to the federal FCA, the CFCA imposes penalties per false claim and allows whistleblowers to bring lawsuits on behalf of the state through qui tam actions.

California’s False Claims Act also includes strong whistleblower protections, preventing retaliation against individuals who report fraud. Additionally, whistleblowers may receive a percentage of the recovered funds, providing financial incentives to expose fraudulent activity. If you suspect healthcare fraud, consulting with an attorney is crucial to understanding your legal rights and potential rewards.

This law ensures that state resources, particularly those allocated to public healthcare programs, are used properly and that fraudulent activity is effectively prosecuted.

Define “Qui Tam”

The term “qui tam” originates from the Latin phrase “qui tam pro domino rege quam pro se ipso in hac parte sequitur,” meaning “he who sues on behalf of the king as well as himself.” In simple terms, qui tam provisions allow private citizens to file lawsuits on behalf of the government or the State of California. Whistleblowers must provide substantial evidence of healthcare fraud, and laws exist to protect them from retaliation. Always consult an attorney before taking action.

Recent California Healthcare False Claims Act Cases

False Claims Act (FCA) cases often involve significant financial recoveries. Fraudulently obtained funds must be repaid to the government, and whistleblowers (known as relators) typically receive a percentage of the recovery. Here are some notable examples:

United States and State of California ex rel. Smith v. XYZ Medical Center – In this case, whistleblowers exposed a major hospital system in California for billing Medi-Cal for procedures that were never performed and misclassifying patients to maximize reimbursements. The lawsuit resulted in a $6 million settlement, with the whistleblowers receiving $1.2 million.

United States ex rel. Johnson v. ABC Diagnostic Labs – This case involved fraudulent claims submitted by a diagnostic laboratory in Los Angeles, where unnecessary tests were added to patient bills. A former employee filed the qui tam lawsuit, leading to a $4.2 million settlement, with the whistleblower receiving $840,000.

California Healthcare Fraud by Region

Healthcare fraud can occur anywhere, but certain areas in California may be more susceptible due to population size, the concentration of healthcare facilities, and other socio-economic factors:

Los Angeles – As the most populous city in California, Los Angeles has a high volume of Medicare and Medi-Cal recipients, making it a prime target for healthcare fraud investigations.

San Francisco – Home to many healthcare research institutions and hospitals, San Francisco has seen cases of fraudulent billing and improper coding.

San Diego – With a large military and veteran population, San Diego has faced cases involving Tricare and VA healthcare fraud.

Sacramento – As the state capital, Sacramento has numerous government-funded healthcare programs, making it a potential target for fraud.

Fresno – With a large agricultural workforce reliant on Medi-Cal, fraudulent medical billing schemes have been uncovered in this region.

Due to the widespread use of Medicare and Medi-Cal services, these regions may be at a higher risk for fraudulent activities.

What Should I Do If I Suspect Healthcare Fraud in California?

If you suspect healthcare fraud in California, maintaining discretion is essential. Your first step should be to contact an experienced California healthcare fraud attorney. An attorney can help navigate the complexities of the California False Claims Act and federal whistleblower laws, ensuring your rights and protections are upheld. If your attorney determines that you have a valid case, they will assist in gathering evidence to support your claim.

During this process, it is critical to keep the matter confidential and refrain from discussing it with others. This allows you time to secure alternative employment if necessary and ensures the integrity of your case. Ultimately, hiring a knowledgeable healthcare fraud attorney is the best way to protect your rights and maximize your potential recovery.

(Note: While this guidance is specific to California, the principles apply nationwide for those facing similar healthcare fraud situations.)