Medicaid is a joint federal and state program that provides healthcare to low income families and individuals. Additionally, Medicaid may assist the elderly and disabled people with nursing home costs and long term care expenses. This care involves tremendous amounts of money. In fact, the federal government website (CMS.gov) states that Medicaid spending in 2022 was $805.7 billion, or 18% of the total national health expenditure (NHE). As a result, it becomes difficult to monitor each medical procedure, prescription, or medical device. Fortunately, laws and statutes exist to prevent fraud. However, greedy people tend to ignore laws for financial gain.

This is where whistleblowers may help. A whistleblower is a person that witnesses illegal activity and reports it. So, if you suspect Medicaid fraud contact an experienced attorney who will advise you in this matter.

Medicaid Fraud Examples

Numerous types of Medicaid fraud and abuse occur throughout the United States. Some examples include:

Receiving kickbacks, bribes, or cash for medical services or supplies

- Billing for services not received

- Providing fake information to Medicaid

- Performing unnecessary procedures

- Overprescribing drugs to a patient

- Overcharging for procedures, medications, or equipment

- Upcoding to obtain more money, putting in a code that pays more money

Recent Medicaid Fraud Cases

Medicaid fraud cases have increased in recent years. In fact, the Medicaid fraud unit receives thousands of referrals each year. In 2023, they received over 4000 referrals. However, only 893 were brought to court. The Medicaid Fraud Control Unit’s Annual Report (2023) further noted that $1.2 billion was recovered and total convictions amounted to 1143 people. Some major Medicaid fraud cases include:

- MedeAnalytics, Inc 2022- This Company overbilled Medicaid in several states. In the settlement, MedeAnalytics agreed to pay $7 million to Medicaid programs primarily in Texas and California.

- Union Healthcare Services Ambulance– The owner of this company in Texas received a 16 year prison sentence for running a Medicaid fraud scheme.

- New Horizons Durable Medical Equipment – the Texas co-owner of this company was sentenced to 49 months in federal prison for Medicaid fraud.

- Wyeth and Pfizer 2016- Both pharmaceutical companies failed to provide discounts to Medicaid patients for the drugs Protonix Oral and Protonix IV. Since Medicaid patients should receive the same pricing as any other consumer, the companies received HUGE fines. In fact, $1.2 billion was recovered and million dollar fines were assessed to the companies.

- Vista Clinical diagnostics, LLC, Access Dermpath, and Advanced Clinical Laboratories, Inc. – These companies are alleged to have violated the Federal False Claims Act. The Medicaid Fraud Unit did recover more than $500,000 in this case. This particular case was the result of a whistleblower.

Advanced Medical Equipment (AME), Louisiana, 2023- A Louisiana man pled guilty to health care fraud and sentenced to three years in prison. He was supplying unnecessary medical equipment to Medicare and Medicaid patients through his durable medical equipment company. AME received $7.96 million dollars. In order to receive fraudulent funds he forged physician notes and numerous medical records. He made over $3 million dollars on the scheme.

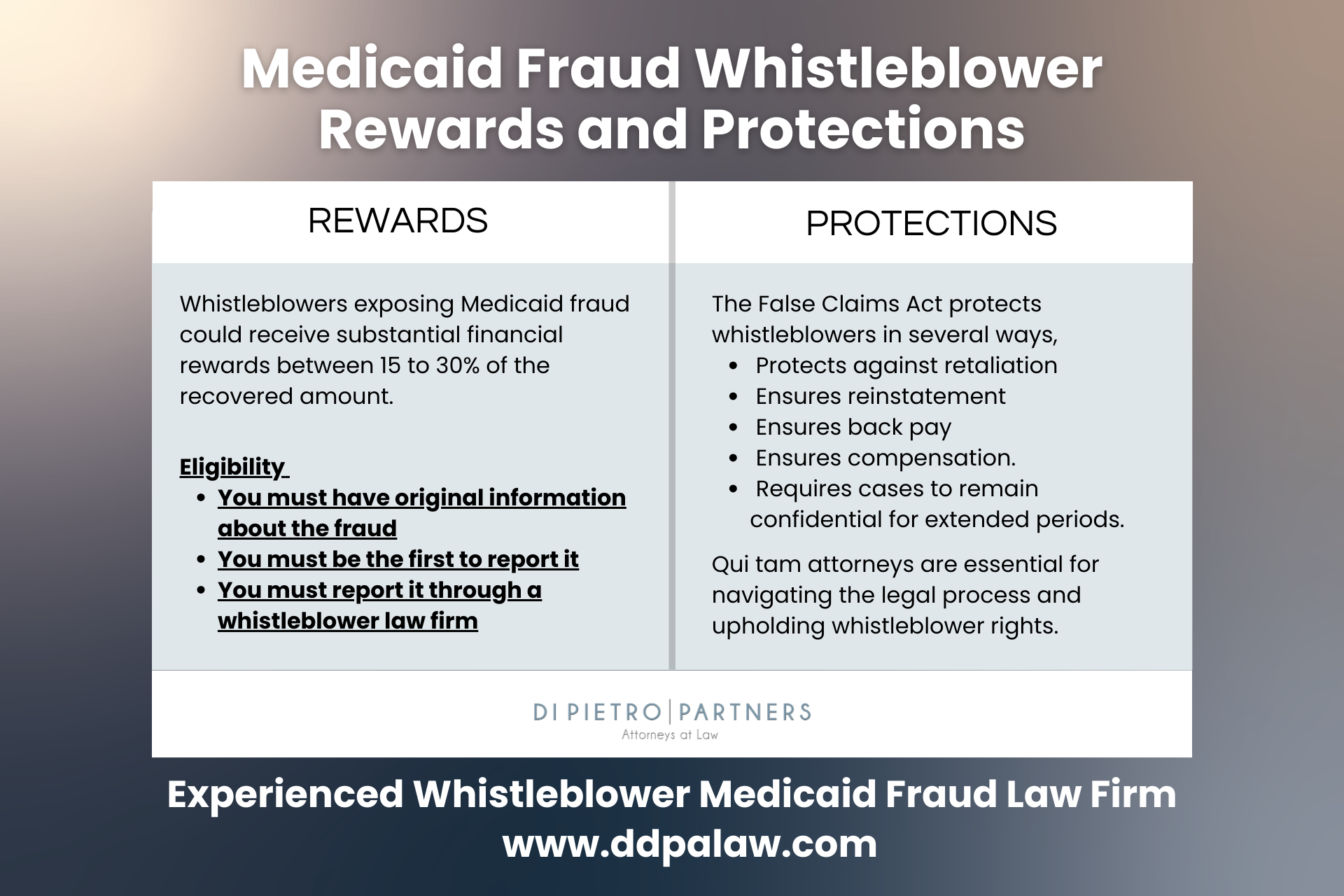

Whistleblower Steps, Protections, and Rewards

The cases illustrate a wide variety of Medicaid fraud. In order to prevent further misuse of tax payer dollars, whistleblowers must have the courage to come forward. The first step is to contact an attorney and keep quiet about the situation. Your experienced attorney will advise you what to do next regarding collecting evidence and supporting documentation. It’s important to note that our legal system provides protections for whistleblowers. Also, after cases are settled you may be entitled to a monetary reward. Many times these cases involve millions of dollars and rewards are quite large. So, if you suspect or know about Medicaid fraud, contact an experienced attorney immediately.

Medicaid Fraud FAQ

Q. What happens when you report Medicaid fraud?

Once you report Medicaid fraud, the report is reviewed by the relevant agency, such as the Office of Inspector General (OIG) or the Centers for Medicare & Medicaid Services (CMS), to determine the necessity of an investigation. If an investigation is deemed necessary, it proceeds confidentially. The specific circumstances of the case will dictate whether you’re contacted for additional information. Outcomes of such investigations can vary, from the recovery of misused funds and imposition of penalties on the perpetrators to potential criminal prosecution in severe cases.

Q. Where do you report Medicaid fraud?

Medicaid fraud should be reported to official bodies such as the Office of Inspector General (OIG), the Centers for Medicare & Medicaid Services (CMS), or the Medicaid Fraud Control Unit (MFCU) of your state. Additionally, the Senior Medicare Patrol (SMP) can offer assistance in fraud reporting and provide valuable resources for Medicaid beneficiaries. Considering the complexity of healthcare fraud cases, involving a specialized Medicaid fraud law firm can greatly benefit the reporting process. These law firms specialize in healthcare law and ensure that reports are comprehensively documented and accurately filed, emphasizing the gravity of the fraud allegations and aiding in the efficient processing and investigation of the case.

Q. How do you report Medicaid fraud anonymously?

If you wish to report Medicaid fraud anonymously, it’s recommended to proceed through a reputable law firm. This approach ensures your legal rights are safeguarded through attorney-client privilege. Although offering your contact details can aid the investigation, it’s not obligatory, allowing for the submission and processing of your report without revealing your identity.

Q. How long does a Medicaid fraud investigation take

The duration of a Medicaid fraud investigation can vary significantly, depending on the complexity of the case, the amount of evidence to be gathered and analyzed, and the level of cooperation from all parties involved. Typically, an investigation might take anywhere from several months to a few years to complete. Initial inquiries and data collection can be time-consuming, and if the investigation leads to legal proceedings, such as trials or settlement negotiations, the timeline can extend further. The specific time frame also depends on the workload of the investigating agency and the efficiency of legal processes in place.

Q. What is the cost of a Medicaid fraud lawyer?

The cost of hiring a Medicaid fraud lawyer can vary widely based on several factors, including the complexity of the case, the lawyer’s experience, and the law firm’s billing practices. The Medicaid fraud attorneys at Di Pietro Partners work on a contingency fee basis on whistleblower (qui tam) cases under the False Claims Act. This means the lawyer only gets paid if you win the case or reach a settlement, taking a percentage of the recovered funds as their fee. This percentage can vary but typically ranges from 20% to 40% of the recovery.