While this may seem like a straightforward process, there are often complicated guidelines, rules and procedures that must be followed in order for a Notice to Creditors to be considered valid and hold up in a court of law. Because of this, it is strongly encouraged to work with an attorney specializing in probate law to ensure that this part of the probate process is done correctly.

General Guidelines of the Process

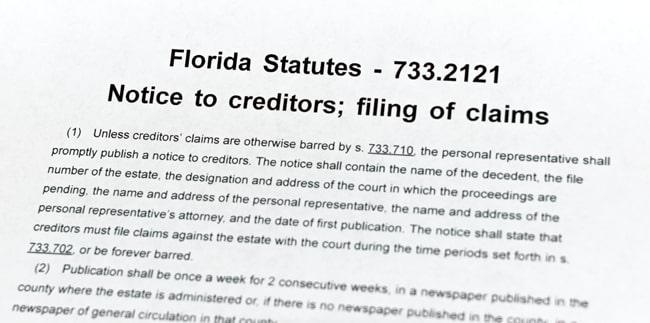

The requirement for giving Notice to Creditors in Florida comes from Florida Statute 733.2121, which states that the personal representative of the estate must immediately publish a Notice to Creditors. This notice must contain the following details of information:

- The decedent’s full legal name

- The file number assigned to the estate

- The designated court in which the case will be filed in, as well as its address

- The name, address and other contact information of the estate’s personal representative

- The name, address and other contact information of the personal representatives attorney

- The date of the notice’s first publication

- A statement indicating that creditors can only file their claims within the periods of time established under Florida Statute 733.702 and 733.710

Per Florida law, the Notice to Creditors must be published weekly for two consecutive weeks in either a newspaper within the county that the estate is being administered or a newspaper of general circulation in that county. Proof of Publication of this notice is required to be filed with the court within 45 days of its first publication. In addition to this, the personal representative must perform a search to determine the name, address and contact information of any creditors of the decedent, even if their claims are not due at the time of the notice. Extensive searching is not required however, as the most important thing is simply that a diligent search was conducted in good faith.

Of great help in the search for creditors is the setting up mail forwarding through the postal service to have the decedent’s mail sent to the personal representative. Billing, credit card and bank statements belonging to the decedent may be received by the personal representative, which will be helpful in identifying creditors. Of these creditors that become known to the personal representative, there must be prompt notice sent of the decedent’s death and a copy of the Notice to Creditors. The only exception to this notification requirement are creditors who have already filed a claim against the estate, those whose claim is paid in full, or whose claim is listed in the personal representatives filed Proof of Claim.

Finally, within a four month period after the notice to creditors has been published, the personal representative must file a Verified Statement with the court stating that they performed their search diligently for all of the creditors who potentially have a claim against the estate. In this statement, the names and addresses of known creditors must be provided, as well as an indication of whether the creditors were served with the Notice of Creditors or were otherwise notified.

Further Steps

Under certain circumstances, there are some further steps that must be completed as part of the Notice to Creditors. For any decedents who were 55 years of age or older at the time of death, there must also be a copy of the Notice of Creditors sent to the Agency for Healthcare Administration (AHCA). This must occur within three months of its publication, unless the agency has already filed a Statement of Claim against the estate. Additionally, if the a copy of the Notice to Creditors hasn’t been received by the Florida Department of Revenue, then a copy of the estate’s probate inventory that is filed as part of the estate administration process can serve in its place per Florida Statute 733.2121(3)(e).