What You Need to Know About Probate

Having a guide to help understand probate steps and proceedings is vital to ensure a successful outcome in this situation. Questions may be asked such as:

- Who is in charge of a will after the decedent passes?

- What is the correct course of action if someone passes without a will?

- Is there any way to avoid the probate process altogether and if so what is the best route to do this?

In this guide the expert attorneys at Di Pietro Partners, PLLC will answer these questions and more.

Table of Contents

What is Probate?

Probate Definitions

Probate Steps

Dying Without A Will

Can Probate Be Avoided?

Summary

What is Probate?

Probate is the process of administering an estate after a decedent passes away. This is handled through the probate court system in the jurisdiction where the decedent resided. In the instance that the decedent had a will, the probate process will primarily involve the proving of the validity of the will itself, as well as executing of its instructions and the payment of any applicable taxes.

Because of the complexity of probate proceedings, it is very important that the will is clearly written in order to keep the process as smooth as possible. Last wills and testaments dictate not only who receives the assets of the estate, but also who will take care of any minor children or dependents that were under the control of the decedent, as well as designating the specific executor of the will.

In the event that the decedent did not have a will, the probate court system is tasked with deciding how to distribute assets according to the intestate laws of the particular state the probate proceedings are within. This can often be a complex and messy situation, involving disputes over asset distributions as well as child custody. In these situations it is strongly recommended for families and those with a vested interest in the decedent’s estate to work with an attorney specializing in estate law and planning in order to ensure they receive the best outcome possible.

Probate Definitions

Probate uses multiple legal definitions that must be understood in order to navigate the process successfully. In order to make things simpler and help individuals through probate proceedings, we have listed the most common definitions in use across all types of probate matters.

Decedent – The deceased person whose assets become their estate, which is then probated through the courts. This includes individuals with and without a formal will. Decedents often have financial obligations to creditors, as well as taxes owed, which come out of their estate.

Executor – The individual who is tasked with carrying out the instructions laid out by the decedent in the will. This person is sometimes referred to as the personal representative, and is usually a third party such as an attorney. However, executors can also be a family member.

Administration – The process of management and settlement of an estate by an individual acting under the authority of the court. This individual will either be an administrator or executor depending on whether the estate is testate or intestate.

Public Administrator – Appointed by the probate court, an administrator is tasked with administering an estate in the event that the decedent passes away without a formal will. They fulfill the same purpose as an executor, although they are not technically one.

Beneficiary – An individual or entity specifically named in a will, trust or testament to receive all or a portion of the assets of an estate. In certain circumstances, the beneficiary may be referred to as a devisee or legatee.

Probate Bond – A type of insurance used to protect the assets of an estate in the event that an error occurs during the probate process. In the event there is an issue, the bond will compensate the beneficiaries for any value or money lost. These are sometimes referred as Fiduciary Bonds.

Codicil – This legal document is used in order to make amendments and changes to an existing will. This must be paired with a will in order to work and there can be multiple codicils attached to a will depending on how many times modifications may need to be made.

Creditor Claim – Filed by creditors with the probate court and those who seek to make a claim against the estate in order to be repaid money they believe they are owed by the decedent. This can include private persons, companies, banks and other lenders.

Escheat – This is the process by which assets of a decedent’s estate revert to the government. This only happens if the court has been unable to locate legal heirs or none have come forward to lay claim to the estate as heirs.

Heirship Hearing – This is a legal process by which the probate court is presented evidence which is used to determine the rightful amount of entitlement to each heir. Depending on the state, any individual who believes they are a rightful heir and entitled to a portion of the estate must file as such with the court if they have not already been identified.

Heirship Order – The official court decision that declares who the entitled heirs are as well as what their respective shares of the assets are from the decedent’s estate.

Inventory – An itemized list of the assets of an estate. This includes cash as well as appraised property and any real estate the decedent may have had.

Testate – A term used to describe the scenario when a person passes away with a proper and valid will. In this instance the estate will then be executed through an executor instead of a court appointed public administrator.

Intestate & Intestacy – Defined as a condition of an estate of a decedent who died without a will. When an estate is in intestacy, the state then takes control of the distribution of its assets between various parties, including creditors, heirs and beneficiaries.

Letters of Administration – This is the document issued by the court which grants the appointed public administrator the authority to handle the affairs of an intestate estate.

Letters Testamentary – A document which is issued by a probate court which authorizes the executor of the estate to begin the process of carrying out the will. This allows the executor to carry out their duties during the probate process, such as paying bills, inventorying assets and making distributions to any beneficiaries.

Notice of Probate & Notice to Creditors – In many states, the executor is required to publish a notice of probate in the local newspaper and other publications. The purpose of this is to give potential creditors of the deceased appropriate and reasonable notice that the estate is being probated.

Small Estate Affidavit, Summary Probate and/or Summary Administration – In certain situations, it is possible to shorten certain aspects of the probate process, or even skip them altogether. For example, this would cover the distribution of property without the lengthy probate court process. Estates that fall below a certain value are eligible for this process, however the exact value ceiling is dependent on the state in which the estate is being probated.

Probate Steps

In order to better understand the probate process, we have compiled a list of the five primary steps involved. While the details will vary depending on the state in which the estate is being probated in, generally speaking they will all follow the same basic set of steps.

- Open Probate

The first step in the probate process is for the executor to file a petition with the probate court, which allows them to start the process of probating the estate by proving the validity of the will. Until this first step happens, they are not authorized to distribute, discard or remove any property from the estate. However, depending on the state in which the estate is located they may be able to take steps to protect the property, such as clearing leaves out of gutters or covering things up with a tarp to prevent weather damage.

It is the role of the probate court to verify whether or not a will is legally valid. Sometimes its validity is disputed by the decedent’s family members or other interested parties, which can raise doubts as to whether it is actually a legal will. Some of these disputes arise out of accusations of undue influence by others when the decedent was setting up their will, or if the decedent was not of sound mind or had impaired mental capacity at the time of the signing. Generally speaking, if it can be proven that the decedent had both a reasonable sense of their assets and a reasonable sense of who they wanted to leave it to, the will should pass through the courts as a valid and legal will.

- Send Notices

After the will has been proven as valid and the executor or administrator is officially appointed by the court, the next step is for the executor to notify any interested parties or creditors that the estate is being probated. Interested parties may be any individuals specifically named in the will, as well as close relatives or family members who would be identified as next of kin by intestacy laws. The executor is not required to notify specific creditors unless they are known or there is good reason to believe that certain creditors may have an interest collecting a debt owed by the decedent. Outside of this, all they are required to do is provide a notice to creditors through the local county newspaper or similar publication that the estate is being probated. Legally, it is up to the creditors to take notice and file a petition with the court to collect from the estate their debts owed.

In the event that a will is uncontested and all interested parties are in agreement regarding its validity, then the process becomes a simple matter of the probate court signing off on paperwork to go forward with the probate proceedings. However, if an interested party has an issue with the will as it has been presented to the court, they can file a dispute with the court to have the will contested.

Contested wills can be a complex and drawn out process. Oftentimes, wills are disputed by family members who have a different version of the will which they believe to be the most valid. In certain cases, interested parties may contest that the will has problems that make it legally invalid, such as undue influence or being signed by the decedent when they were not mentally fit to do so. In other instances, the beneficiaries or heirs may disagree about how the estate is being handled, and/or the distribution of assets.

In order for a will to be successfully contested, the interested party must present a compelling case that will convince the judge to weigh in on the issue. As a general rule of thumb, the more parties involved in the contesting of a will the more likely a probate judge will become involved. Otherwise, these disputes will be dismissed and the probate process will continue with the will as it originally was written.

During the notice period, creditors have a limited amount of time in which they can submit a claim for any outstanding debts the decedent may have had. The courts generally only become involved in this portion of the process under two different scenarios. The first is when an executor seeks to deny a creditors claim by disputing its validity, in which case it would be up to a judge to decide who is in the right. The second is when the executor would be forced to sell significant assets such as a house in order to pay creditors. In this scenario the beneficiaries can bring this decision up to a judge if they disagree with the executor on what is the best course of action.

- Take Inventory

Inventory is the next major step in the probate process. During this stage, the executor is tasked with assessing the total value of the estate, including all assets of the decedent at the time of their death. The complexity of this step can vary widely depending on the type and volume of assets the decedent had. For example, if the decedent primarily had their assets in bank accounts, stocks or other easily identifiable financial assets, it would be a simple task to take inventory.

However, if there are significant physical assets such as jewelry, vehicles or real estate, then the executor would need to consult with a professional appraiser in order to be sure that the inventory value is accurate. The accurate valuation of the assets of the estate during this inventory process is vital because of the way in which assets are divided among beneficiaries – usually on a percentage of the overall estate value. To ensure transparency, the executor is required to send copies of the inventory to all interested parties, including the judge and beneficiaries or heirs.

- Distribute Assets

The distribution of assets and administration of the estate is usually the most time consuming portion of the probate process, sometimes taking several months to complete when large assets such as a house are involved. In fact, it is such a large task that executors are entitled to compensation for their efforts, the amount of which is dictated either by state law or the will itself.

Issues that often arise are related to disputes brought up by beneficiaries as to how the executor should be fulfilling their duties, such as how they are going about selling a property or handling other administrative issues. In certain cases, beneficiaries may take issue with the compensation of an executor even if the will or state law provides for it. In these cases the executor will generally get compensated regardless of whether the will provides for it or not.

One thing that can happen during the process is when a will leaves money to minors. This can draw out the probate process for a significant amount of time, due to the fact that minors are not legally allowed to accept an inheritance directly. Instead they must have a trust where it can be deposited, and the court will appoint a trustee to manage it until the minor becomes an adult.

Otherwise the distribution of the estate is a straightforward process. The executor will use assets of the estate to pay the decedent’s debts, taxes and submit policy claims such as a benefcary’s life insurance claims related to the decedent’s passing. During this process the executor will also make sure loose ends are tied up such as closing retirement or other automatic deposit accounts. Lastly, the executor will usually be tasked with selling or liquidating assets, and make sure all possessions go where they are supposed to – whether that be to a heir, beneficiary or to be disposed of at the dump.

- Close Estate

The last and most straightforward step of the probate process is the closing of the estate. This occurs after all assets have been distributed, sold or disposed of and the court and executor have been compensated. In order to finally close an estate and conclude the probate process, a petition to dissolve the estate must be filed with the court. It should be noted that even after this petition has been completed and the estate has been formally closed, probate is a matter of public record and any interested person can view the legal records of the estate’s probate process.

When Someone Dies Without A Will

When someone passes away without a valid will in their assets are declared “intestate.” This means the courts will have to decide who should receive assets in the absence of a will dictating the beneficiaries and appointing an executor. Generally speaking across all states, the probate courts will appoint a public administrator to act as an executor of sorts to administer the estate throughout the process.

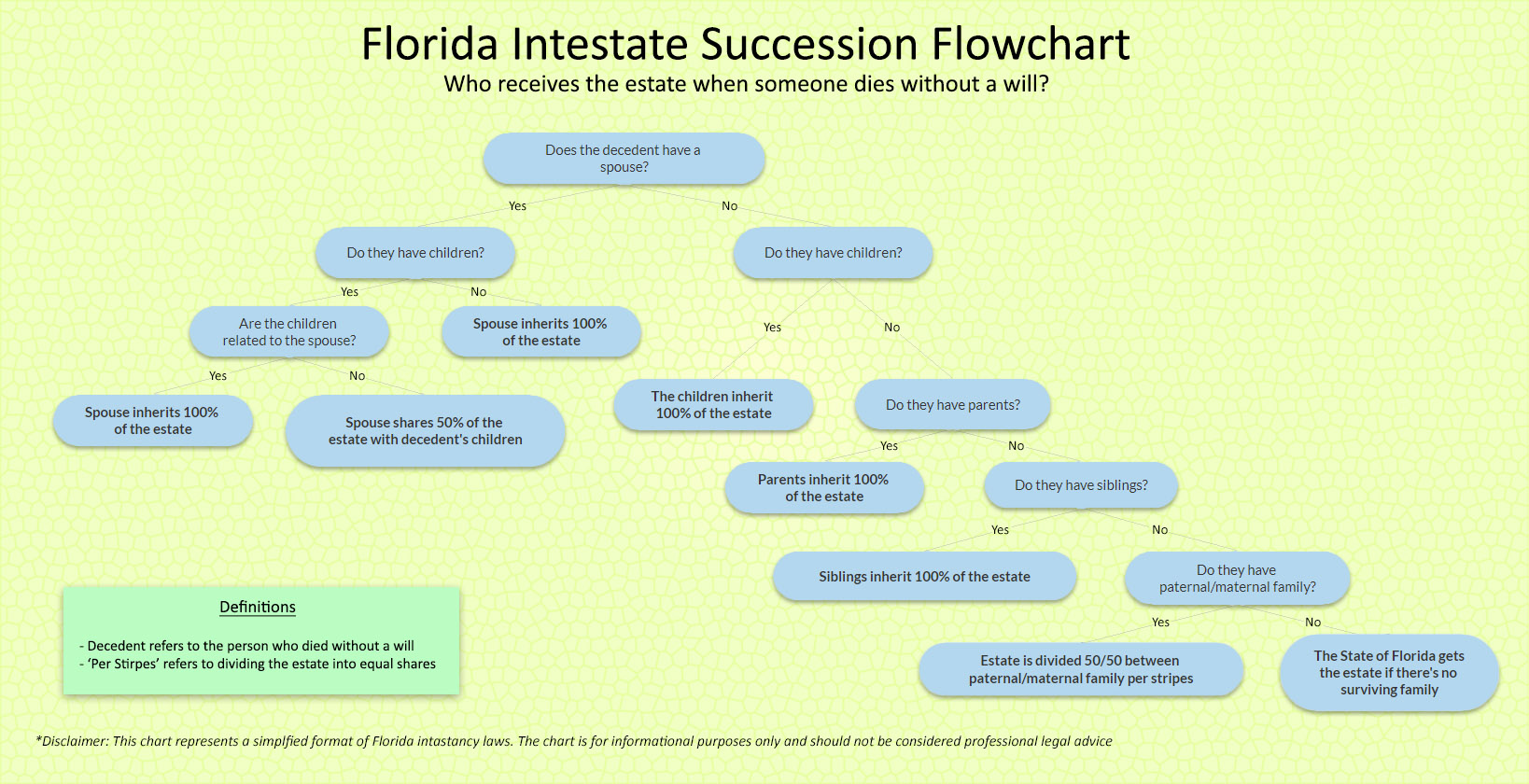

Each state has their own individual process for intestate succession. For example, below is a simplified flowchart showing Florida’s intestate succession process. You can read more about this process in our comprehensive Florida probate guide.

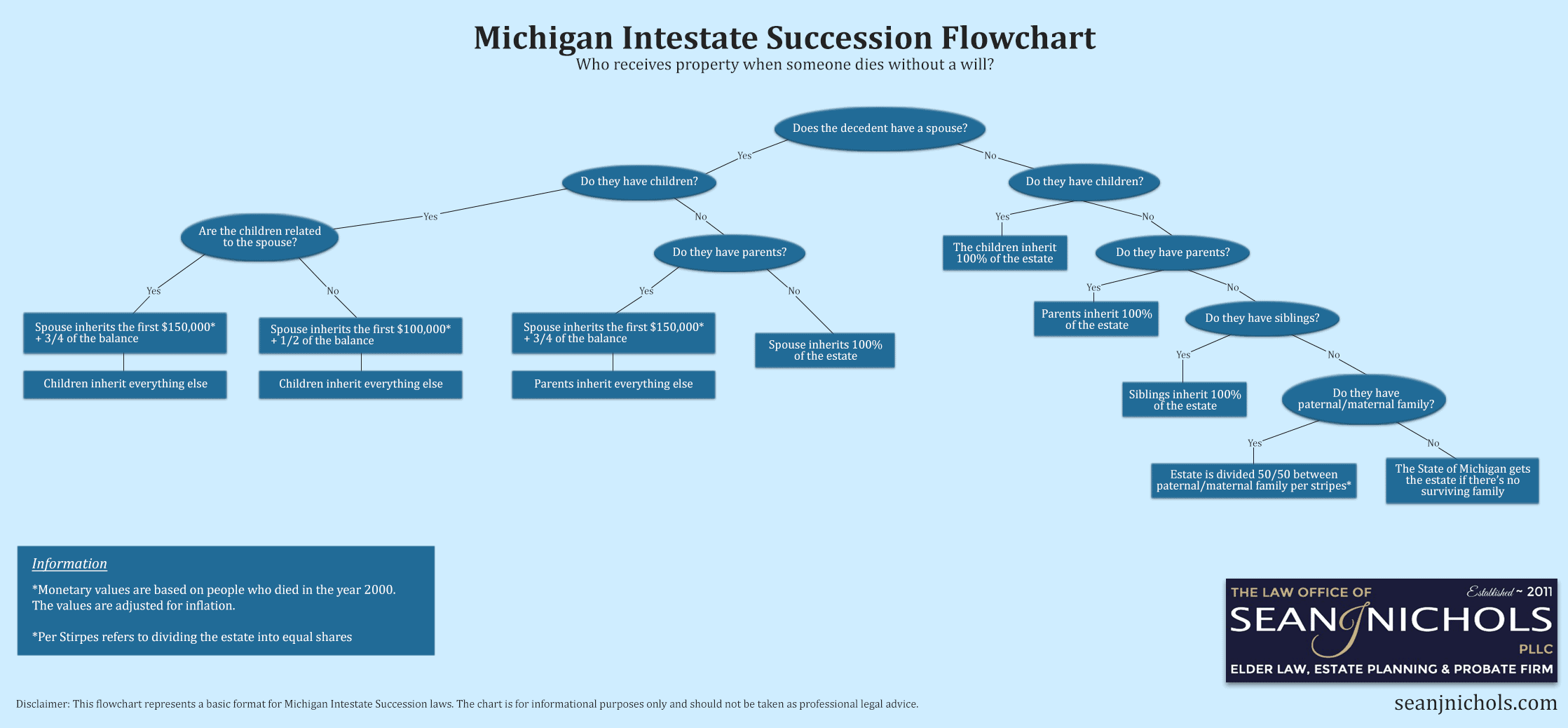

Florida’s intestate succession process is fairly straightforward assuming the decedent did not have multiple spouses/families throughout the course of their life. On the other hand, certain states such as Michigan, have more complex inheritance laws that take into account factors such as inflation. You can see an example of this complexity in the Michigan Intestate Succession flowchart below.

Regardless of where the decedent passed away, it’s important to check individual state laws regarding probate and intestate succession. An attorney that’s licensed in your state who practices in probate can help you through this process.

Should I Avoid Probate?

Probate can be a lengthy and sometimes expensive process depending on how the estate is left when the decedent passes away. Because of this, many find it beneficial to avoid the probate process if at all possible. One of the first benefits besides saving on court and executor fees is the speed at which beneficiaries will receive their funds. Avoiding probate can often result in a simpler and faster route for beneficiaries to receive their distributions from an estate. Additionally, those interested in privacy will appreciate an estate avoiding the probate process as they will not appear in public records, keeping often sensitive information from prying eyes.

All that being said, there are benefits to going through the probate process. In certain cases, relying on a will to dictate how assets should be distributed is the best choice. This is especially true when the decedent wants their intent as clear as possible. By having their will processed through the probate system, it gives them the best opportunity to communicate their wishes and backup plans clearly.

In addition to this, wills allow the decedents to leave money to organizations such as charities, schools and colleges. Sometimes when a decedent’s estate bypasses probate they are only allowed to distribute to individuals and are prohibited from giving to non-human benefactors. This will depend on the laws and regulations of the state in which the estate is located as well as the particular type of account being distributed.

On top of all of this, one of the most important benefits of allowing an estate to go through the probate process with a proper will is to give creditors less of an opportunity to collect from an estate. This can be especially beneficial for estates that may have a muddy history when it comes to creditors or debts owed by the decedent. It is also beneficial for larger estates with high asset values as these can be quite appealing for creditors to go after.

Summary

It should be clear by now that the probate process is a time consuming and complex process to navigate. Regardless of the state that it takes place within, there are multiple steps that must be rigidly adhered to, as well as many unpredictable and sometimes unexpected outside variables that can add to further challenges along the way. All of this normally falls upon a decedent’s family after their passing, which can be especially difficult considering they are also in the midst of the grieving process.

The best way to navigate probate proceedings is to work with a licensed attorney in the state in which the decedent resided at the time of their death. This will take the burden off the shoulders of the decedent’s family members and in certain cases can save a tremendous amount of money and assets from being siphoned off the estate due to mishandling by inexperienced persons during the probate process.

If a decedent passed away in the State of Florida and you are in need of legal assistance to work through the probate process, our Florida probate lawyers are ready to help. Give us a call today to schedule a free consultation.