An estate attorney plays a vital role in helping individuals and families safeguard their assets during life and ensure a seamless transfer of wealth after death. Also known as an estate planning lawyer or probate attorney, their work encompasses strategies to avoid unnecessary taxation, reduce legal complications, and streamline the probate process to save time and expense.

Because of the complex nature of Florida probate procedures and unique homestead laws, the guidance of an attorney experienced in estate matters is essential for preserving a client’s financial legacy and avoiding costly legal missteps.

Understanding Estate Planning

Estate planning goes beyond writing a will. A thorough plan prepares for incapacity by granting trusted individuals authority to make medical and financial decisions through durable powers of attorney and healthcare directives. It also establishes how assets will be distributed after death, helping families avoid conflict and ensuring a person’s wishes are carried out. These tools provide clarity and protection during difficult times while preventing unnecessary court involvement.

In Florida, estate planning carries unique challenges. Homestead protections restrict how primary residences may be transferred, elective share rights guarantee spouses a share of the estate, and strict statutory requirements dictate how documents must be executed. Generic online forms rarely account for these rules, often leaving families exposed to disputes or invalid plans. Working with a Florida estate attorney ensures documents are tailored to personal circumstances and compliant with state law, preserving both assets and intent.

Key Roles of an Estate Attorney

Estate attorneys serve several key roles in Florida estate planning. Primarily, their job involves drafting the legal documents that form the foundation of the plan. These documents include wills, trusts, durable powers of attorney and healthcare directives. It is important that each of these are carefully tailored to reflect the client’s family, financial situation, and long-term goals. Beyond preparing documents, attorneys ensure they meet Florida’s strict statutory requirements so they are legally valid and enforceable in order to prevent disputes and ensure the client’s wishes are carried out as intended.

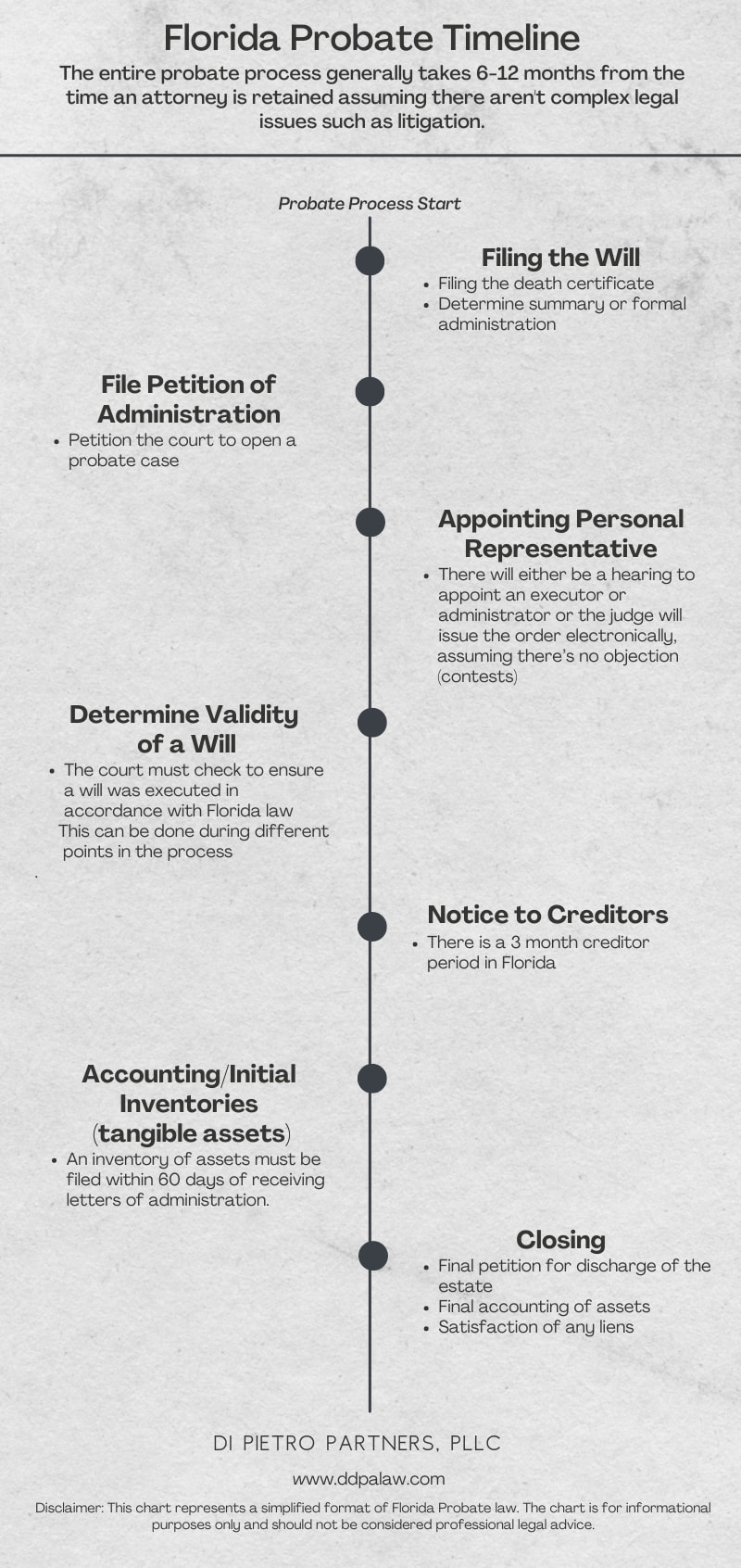

Estate attorneys also provide tax and administrative guidance. While the State of Florida does not impose an estate or inheritance tax, federal estate and gift taxes can have a significant financial impact on wealth transfers. Strategies such as lifetime gifting, charitable donations, and advanced trusts are used in order to minimize tax burdens in estates. In addition to this, attorneys also provide assistance with estate and probate administration proceedings, as well as non-probate transfers such as trust distributions or accounts with beneficiary designations.

Conflict Resolution and Fiduciary Guidance

Even with a well prepared estate plan, disputes may still arise among heirs, beneficiaries and fiduciaries. An estate attorney helps resolve these conflicts through negotiation or mediation, and by representing clients in probate litigation when necessary. Their involvement can reduce tension, protect family relationships and ensure that disagreements do not delay the distribution of assets.

Attorneys also provide essential fiduciary guidance. They advise on fulfilling legal duties, acting in the best interests of beneficiaries, and complying with Florida’s strict probate and trust laws. By offering ongoing counsel, estate attorneys help fiduciaries avoid costly mistakes, maintain transparency, and carry out the decedent’s instructions properly.