Florida Probate Rules And Processes

Probate is a necessary court-supervised legal process used for the verification and administration of an individual’s assets after death. This legal process varies from state-to-state and is necessary to ensure assets are correctly distributed to beneficiaries. This article discusses Florida probate rules and processes.

It’s important to note that information within this page can help guide someone in the right direction and answer general questions; however, this is not a substitute for professional legal advice. Consulting with an attorney for probate is not only advised, but required in the State of Florida (with only one rare exception discussed in the article).

— Table of Contents —Free Guide On Probating a Will in Florida

What is Probate?

Probate is a court-supervised process that distributes assets of deceased individuals. The court assigns a personal representative (PR) to carry out the terms of a will. Usually this person is named in the will document. When a person passes away without a will, the court assigns a PR to coordinate estate matters. The personal representative has many duties and may wish to consult an attorney for guidance. Simply put, duties fall in three categories:

- Compiling assets- This involves assembling, securing, and valuing the decedent’s property.

- Paying bills- Any monies owed to creditors, all taxes, medical bills, utility bills, and every debt must be paid before closing out the estate.

- Distribution to heirs- After all bills are paid, inheritance funds and property are distributed according to the will. If there is no will, Florida’s intestate succession laws dictate how funds and property pass to heirs.

Florida Statute 733.212 requires a PR to mail notices to all beneficiaries. The representative must also provide written notice to creditors (Statute 733.2121). Since there are legal requirements attached to the personal representative’s duties it remains wise to contact an experienced attorney for guidance throughout the process.

Probate Definitions

To help readers better understand the context of the article, here are some of the most common terms found within this content and/or used throughout the probate process.

Administration – This refers to the legal distribution of someone’s assets in Probate Court after they pass away.

County Clerk of Court – In Florida, most probate hearings are done through the County Clerk of Court in the County in which the decedent resides at the time of their death. This is not to be confused with an actual clerk in the courtroom.

Decedent – A deceased individual

Intestate – When someone dies without a valid will, the State of Florida declares the property of the deceased “intestate.” This will be discussed further in the article.

Probate Court – This is commonly used to describe the court at which the probate hearing takes place even though most hearings are done at the County Clerk of Court.

Personal Representative – Someone who’s legally appointed to oversee the distribution of assets from a deceased person’s estate.

Beneficiary/Beneficiaries – An individual, or group of individuals who are named in a will/estate plan to receive a certain amount of someone’s assets after this person passes away or becomes unable to manage their assets.

Executor – Someone written in a will or delegated by the court to take care of a deceased individual’s financial obligations.

Notice of Administration – Formal notice given to beneficiaries and other interested parties by the personal representative. The notice is legally required in Florida and serves the purpose of providing specific details on the probate proceedings.

Probate Litigation – Basically, this is used to describe a legal dispute during the probate process. The most common types of probate disputes include: challenges to wills/trusts, legal disputes over guardianship, etc.

Probate Process Overview

Under Florida law, there are three main types of probate: formal administration, summary administration, and disposition without administration. Below is a description of each of these three kinds of probate proceedings.

Formal Administration – Formal administration is also simply referred to as “formal probate.” As the name suggests, this type of proceeding is the standard form of probate and by far the most common. Formal probate administration takes place in the local Circuit Court of the County in which the decedent resided at the time of their death. The process starts once an individual passes away and the executor of the will (or other interested party) asks to be appointed as personal representative of the decedent’s estate. The beneficiaries named in the estate are then provided notice and given a chance to raise any formal objection(s).

Summary Administration – This form of probate is available when the total value of property/assets going through probate court is valued at $75,000 or less. Summary Administration may also be used when it involves a death that occurred over two years ago (i.e a missing person recently declared dead). The process of this type of administration is initiated by filing a Petition for Summary Administration that must be signed by a surviving spouse and/or beneficiaries. In short, this is an expedited version of probate.

Disposition Without Administration – As the words “without administration” may suggest, this process actually involves skipping the probate hearing entirely due to a specific set of circumstances. It’s important to note, this is only available when the deceased individual did not leave any real estate at all, and the only assets available for probate are valued at less than the amount of final expenses after probate. In short, disposition without administration occurs when a probate hearing is infeasible from a monetary perspective.

Since there’s no formal court hearing for administration, in order to recover assets, a form must be filed called the “Disposition of Personal Property Without Administration.”

What Happens in Probate Court?

The probate process begins when the custodian of the will deposits the original document with the Court clerk. The clerk will start a file which includes a death certificate. There is a fee for opening a probate case file. The next step involves a circuit court judge.

The judge must confirm all beneficiaries’ identities and assign a personal representative. If this person is named in the will, the judge will examine their qualifications. If the named individual meets necessary qualifications, the judge issues “Letters of Administration.” At this point, the PR takes over the estate administration. Of course, if disputes arise later on, the judge may hold a hearing to settle matters. Once again, an attorney’s advice is necessary throughout the process.

Does Florida Recognize Transfer on Death Deeds?

No. Florida does not recognize property transfer on death deeds. Real estate may not be transferred in this manner. In Florida, a Ladybird Deed operates like a transfer on death deed. Some estate plans use a ladybird deed. Generally, married folks own property jointly. Thus, if one spouse passes away, the property goes to the other. However, if anyone is the sole owner of a home, property, or piece of land, that real estate must go through probate court before inheritance may take place. In Florida, if a married couple does not own property jointly, probate court follows Florida’s state intestacy laws. In this situation, the surviving spouse may not inherit the entire property. In other words, other family members may receive a fraction of the real estate. So, hire an experienced attorney when navigating any probate case.

How Long Do You Have to File Probate After Death?

Florida’s Probate Process includes numerous laws and deadlines. If you have a copy of the will and are named the executor (PR), you have ten days to notify the court of the decedent’s death. Of course, sometimes folks are not notified immediately about the death of a loved one, or they may live far away. The court recognizes this fact and will not throw you in jail for being late on this. However, the court must accept the will as valid before the probate process can begin. Once the court verifies the will, the court issues “Letters of Administration.” The court issued document officially recognizes the executor as a personal representative. This may take several weeks. So, it remains vital to notify the court quickly.

If a family member dies intestate (without a will), an heir must go to court and obtain “Letters of Administration.” In this case, probate court assigns a relative to serve as the personal representative. This assigned person has the authority to settle all matters regarding the decedent’s estate. Once again, an experienced probate attorney can guide your family through this process.

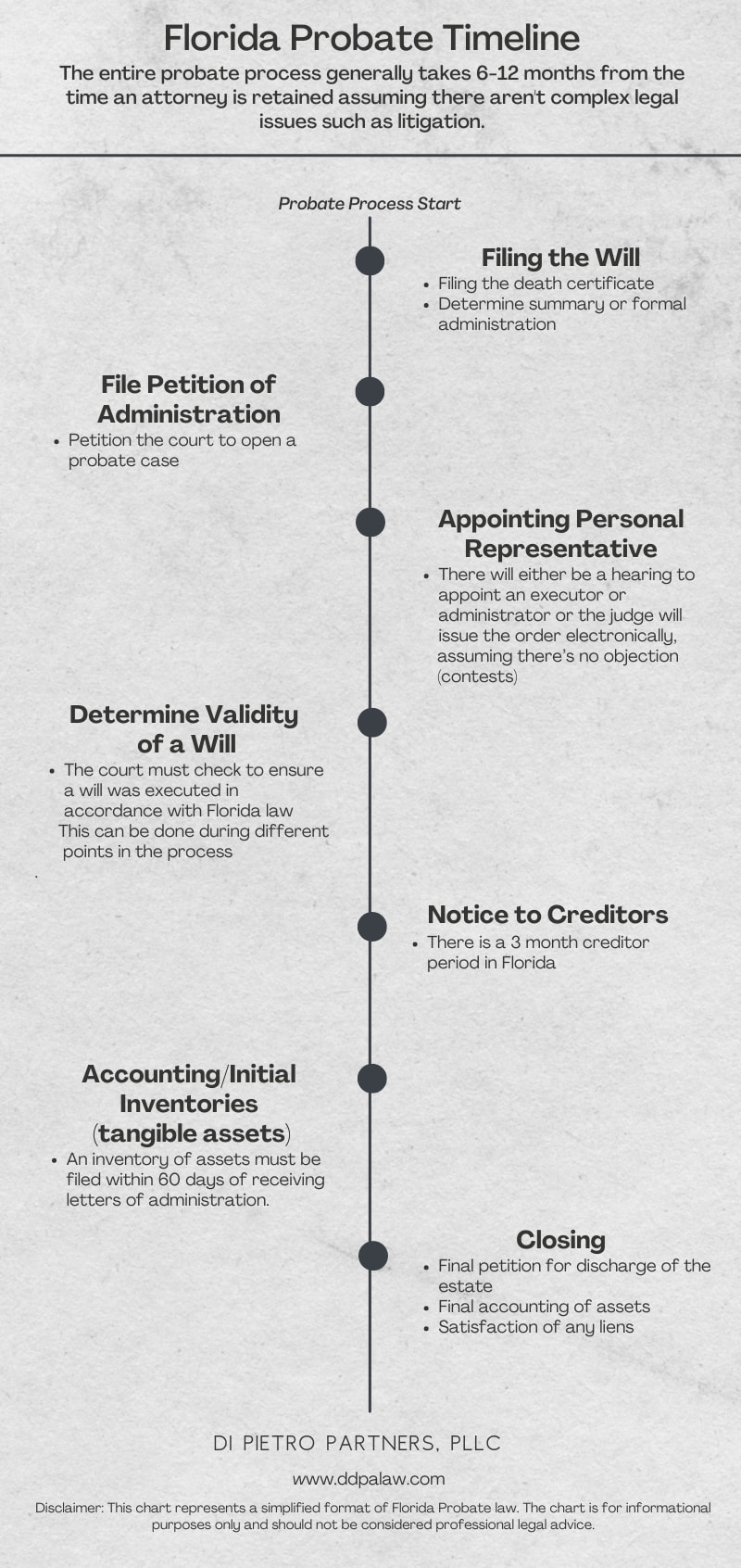

Florida Probate Timeline

This section provides information on each major step involved in the Florida probate process.

- Filing The Will

The person who’s responsible for the will needs to file the legal document with the Florida Circuit Court within the county which the testor resides in at the time of death. For example, if someone passes away in Fort Lauderdale, they will need to file the will within the Broward County Probate Court. - Petition for Administration

Filing a Petition for Administration is the next step involved in this process. This is basically a formal request to probate a will. - Appoint Personal Representative

The next step is the appointment of a personal representative. This individual is responsible for gathering and distributing assets of the individual who passed away. You can read more about appointing personal representatives and their duties in this article. - Determine Validity of a Will

The court must check to ensure a will was executed in accordance with Florida law. That is, the will must be signed, witnessed, notarized, and filed properly and without undue influence. This can be done at different points during the probate process. the personal representative of the estate must immediately publish a Notice to Creditors. - Notice to Creditors

The Notice to Creditors is the formal notification process that gives creditors the opportunity to become aware of the decedent’s death and participate in the settling of debts during the probate process. This notification is an important step because it ensures that creditors cannot make future claims in that they were not properly notified during the probate proceedings. The Notice to Creditors must be published weekly for two consecutive weeks in either a newspaper within the county that the estate is being administered or a newspaper of general circulation in that county. Proof of Publication of this notice is required to be filed with the court within 45 days of its first publication. - Accounting

The personal representative must account for all assets within the estate. This includes listing all disbursements and providing receipts for necessary transactions. After all assets in the estate are accounted for, notice will be given to all interested parties (i.e. creidors, etc). These interested parties will have 30 days to file a dispute. After these 30 days, the probate court will hold a final hearing to authorize this accounting. - Closing

After accounting has concluded, the personal representative will file a final petition for discharge of the estate. Once all assets are distributed and all debts have been taken care of. The court enters an order to finally close the estate.

Common Questions About Florida Probate

When is Probate Required? – Most assets go through probate court in Florida. However, if the decedent has a well-executed trust document the family may avoid probate court. Also, any property held in joint tenancy with full survivorship rights avoids probate court. Bank accounts, IRA’s, 401K’s, and any financial assets with POD or beneficiary designations pass directly to heirs and do NOT go through probate court. However, any assets without proper beneficiary designations must go through the probate process. Banks and other institutions will not release funds without proper transfer designations. So, if a family member passes away without a proper estate plan contact an experienced probate attorney immediately.

What is Probate Estate? – Probate Estate is another term for Estate Administration under the supervision of Probate Court. When someone passes away without a will, or trust, the estate will most likely go through probate court. Family members must contact the court before they can sell the deceased person’s belongings. For example, if someone passes away and solely owns a $35,000 car, the family may not transfer ownership without the court’s permission. Probate court will assign a personal representative and issue proper paperwork for that person to settle all financial matters. Once the court issues the Letters of Administration the personal representative begins the process of settling the deceased loved one’s affairs. Estate matters are often complicated and require an attorney’s assistance.

How Long after a Person Dies Will Beneficiaries Be Notified? – Personal Representatives must follow timelines settling Florida Probate cases. Once the court assigns a personal representative that individual must notify all heirs and beneficiaries. After viewing the will, or learning about any inheritance, beneficiaries may disagree, or object, to terms, financial conditions, or any other part of the proceedings. However, there is a very limited time to notify probate court regarding any objections. Considering the time constraints, one should hire an attorney immediately for assistance.

Do all estates require probate? – All estates do not go through probate in Florida. If a person passes away without a will or trust and has assets in their name ONLY, then probate is required to distribute property and monies. If property, bank accounts, insurance policies, annuities, 401K plans, and all assets have beneficiaries or joint owners, probate is unnecessary. However, without a will or trust all assets must pass through probate court if no beneficiary or joint owner is named.

What Assets Go Through Probate? – In Florida, most assets are required to go through probate; thus, it’s easier to list assets that don’t go through this process. First off, assets that are held within a living trust, may avoid probate. Also, property that is shared through a “joint tenancy,” may also avoid this process. Examples of a joint tenancy include a house that’s owned by a couple, a bank account shared by one or more individuals, etc. There are other assets that may avoid probate under certain circumstances including: life insurance policies, and retirement accounts.

Do I need an attorney? – The short answer is yes. In the State of Florida, it’s legally required to have an attorney represent you during a probate hearing in all except in a few rare circumstances.

How long does probate take? – This will depend on a variety of factors such as: the size of the estate, whether or not there’s an estate plan, if there’s a dispute with creditor(s) or beneficiaries, the quality of legal counsel, etc. With that said, it’s reasonable to expect the average Florida probate process to take between 6 to 12 months.

What happens to someone’s bank account after they die? – If the deceased individual has a beneficiary or Payable on Death (POD) listed on the account or has established a sound estate plan with a trust, their heirs will be able to access the funds. However, In cases where someone dies without the aforementioned provisions in place, the bank will not release the money.

For example, if a family member of the deceased presents a death certificate and has no trust document to prove they are the rightful heir, the bank holds on to the money. In this case, the estate must go through probate to access the funds.

Of course, having a valid will in place and/or hiring experienced legal counsel increases the likelihood of a smooth and prompt hearing.

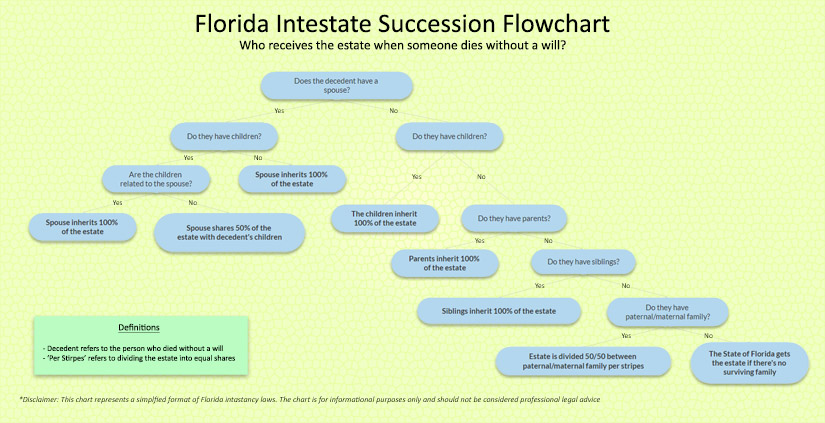

When Someone Dies Without a Will

When someone dies without a valid will in Florida, their assets are declared “intestate.” It’s important to note, that “intestate” does not mean that the property now belongs to the State of Florida. In fact, Florida has a specific process in determining who receives the decedent’s assets in the absence of a valid will. The full process can be found in Chapter 732 of The Florida Statutes. Below is a summary of this process.

- When the decedent has a surviving spouse and has no living children, grandchildren, parents, etc, then the spouse shall receive the entire estate.

- If the decedent has a spouse and also has one or more living family members who are family members of the spouse (i.e children), the spouse shall receive the entire estate.

- If the spouse has additional living immediate family members that are not immediate family of the deceased individual, the spouse shall receive one-half of the estate with the other half going to the spouse’s descendants.

- In cases where the decedent was not married at the time of their passing, the immediate family members will receive the entire estate. The assets will then be divided in accordance with Florida law.

- If the deceased person was not married and also has no living immediate family members, the inheritance will pass to surviving parents of the decedent.

- In cases where someone dies without any surviving close family members, spouses, or relatives, the State of Florida will search for more remote heirs in accordance with intestate law.

- As discussed, this is a summarized version of the Florida probate law specific to intestate succession and wills. The full laws are more in-depth and have various exceptions depending on several circumstances. To put this in perspective, here’s an excerpt from section 732.108 of the Florida Statutes regarding adopted children/children born out of wedlock.

“For the purpose of intestate succession by or from an adopted person, the adopted person is a descendant of the adopting parent and is one of the natural kindred of all members of the adopting parent’s family, and is not a descendant of his or her natural parents, nor is he or she one of the kindred of any member of the natural parent’s family or any prior adoptive parent’s family, except that:

(a) Adoption of a child by the spouse of a natural parent has no effect on the relationship between the child and the natural parent or the natural parent’s family.

(b) Adoption of a child by a natural parent’s spouse who married the natural parent after the death of the other natural parent has no effect on the relationship between the child and the family of the deceased natural parent.

(c) Adoption of a child by a close relative, as defined in s. 63.172(2), has no effect on the relationship between the child and the families of the deceased natural parents…”

(The Florida Legislature, 2018, Adopted persons and persons born out of wedlock.)

As you can see, this process is very in-depth and often causes confusion/disagreements among beneficiaries. As a result, it’s vital to work with a lawyer that’s experienced in Florida probate rules when it comes to issues involving probate court/intestate succession.

Disputes in Probate Court

Ideally, the final wishes of the decedent are written in a will and agreed upon among beneficiaries; however, this isn’t always the case. As previously discussed, the process becomes more complex when someone dies without a will, or there’s a legal dispute such as a contested will, or challenges to a trust.

In Florida, wills may be contested on the grounds of validity (i.e the will wasn’t properly executed). Wills may also be challenged when the person drafting/changing the will does not have legal mental capacity to understand the impact of these documents. These are only a couple examples of legal disputes over wills; the facts and circumstances differ for each case and an attorney is required for the litigation of wills in court.

Similar to a will, a trust may also be challenged in court. Legal disputes over trusts may include: lack of mental capacity by the settlor, undue influence over the settlor, improper witnessing/execution of the trust, and a multitude of other reasons. Trust disputes are even more complex than wills; thus, legal counsel is absolutely necessary in these scenarios.

These types of cases are also done through probate; however, they’re commonly referred to as “probate litigation,” as opposed to “probate administration.”

Summary Of Florida Probate Rules

When it comes to probate in Florida, there are three main types of administration. This includes formal administration, summary administration, and the rare occurrence of disposition without administration. Formal and summary administration account for almost all probate cases throughout the state. In these cases, legal representation is not only advised, but required by law. Legal representation is also required when someone dies without a will, or when there’s a dispute(s) over wills, trusts, guardianship.

If you would like to learn more about Florida probate rules, or have an issue that pertains to probate administration/litigation, anywhere within the state, call the number below for a free consultation with an experienced lawyer today.

954-712-3070 (Local)

800-712-8462 (Toll free)

Florida Probate Law Updates (By Year)

2021 Amendments to Florida Probate Rules

In 2021, the Florida Supreme Court adopted amendments to the Florida Probate Rules, as proposed by the Florida Probate Rules Committee.

| Rule Number | Notes |

|---|---|

| Rule 5.405(b) | Added Rule References to Section R. 5.405(b). Proceedings to Determine Protected Homestead Real Property |

| 5.200 (Petition for Administration) | Added subdivision (k) (2) which requires someone applying for guardianship to reveal any prior convictions of elder neglect. |

| 5.320 (Oath of Personal Representative) | The Oath form was updated with a section stating that a guardianship applicant has never been convicted of elder abuse, elder neglect, or exploitation. |

| 5.340 (Inventory) | Updated section R.5.405. Rule References to Florida Probate |

| 5.402 (Notice of Lien on Protected Homestead) | Updated section R.5.405. Rule References to Florida Probate |

| 5.403 (Proceedings to Determine Amount of Lien on Protected Homestead) | Updated section R.5.405. Rule References to Florida Probate |

| Rule 5.404 (Notice of Taking Possession of Protected Homestead) | Updated section R.5.405. Rule References to Florida Probate |

| Rule 5.405 (Proceedings to Determine Protected Homestead Status of Real Property) | Amended title and section (a) with adding “status of” in accordance with F.S. 736.0201(f). Added a phrase that protects homestead status of property within a trust Amended section (b) (4) by removing the conjunction; Amended section (b)(5) which requires the petition of statement for how property is titled when the decedent passes away Renumbered the final section as s (b)(6). |

| 5.555 (Guardianships of Minors) | Changed “property” to “asset” to Florida Statute 69.031 |

2022 Amendments to Florida Probate Rules

The Florida Probate Rules Committee, in compliance with Florida Rule of General Practice and Judicial Administration proposed amendments for 2022.

| Rule Number | Notes |

|---|---|

| Rule 5.080 | Rule 5.080. Discovery and Subpoena was proposed to be amended |

| Rule 5.040 | Subdivision (a)(6) is amended to note evidence of formal notice is not required when sent by first-class mail. Subdivision (e) is amended to refer to subdivision (a)(5). |

Cited Sources

- Florida Legislature (2022). The 2022 Florida Statutes (including 2022 Special Session A and 2023 Special Session B). Retrieved from http://www.leg.state.fl.us/Statutes/index.cfm?App_mode=Display_Statute&URL=0700-0799/0733/Sections/0733.212.html

- Amendments to The Florida Probate Rules — 2021 Fast-Track Report. Retrieved from https://www-media.floridabar.org/uploads/2021/11/Amendments-to-The-Florida-Probate-Rules-%E2%80%94-2021-Fast-Track-Report.pdf

- Florida Probate Rules Committee https://www.floridabar.org/about/cmtes/cmte-cm230/