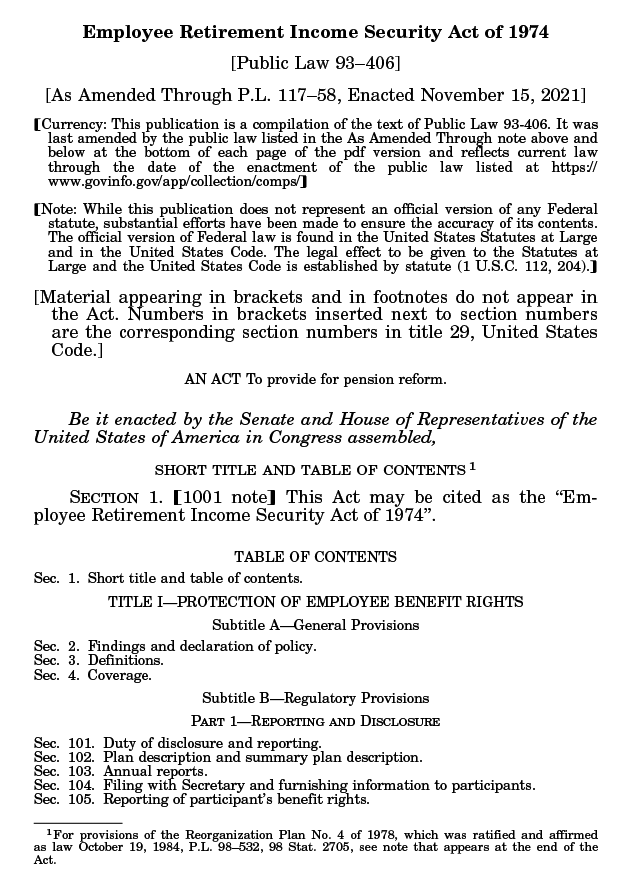

ERISA is an acronym for the Employee Retirement Income Security Act of 1974. This federal law protects pension and healthcare benefits for workers in private companies. Additionally, the statute sets standards for benefit plans. ERISA is enforced by the Pension Benefit Guaranty Corporation, the IRS, and the Labor Department’s Employee Benefits Security Administration.

Employers must follow guidelines established by ERISA when setting up healthcare, 401K, benefit packages and pension plans. Failure to follow ERISA rules may result in civil or criminal charges. These charges may result in hefty fines. So, seek legal counsel when setting up plans for your private business, or if you feel your company has committed an ERISA violation.

What is ERISA’s Purpose?

ERISA’s main purpose is to protect employee’s benefits and to provide transparency regarding benefit plans. For example, once an employee is vested in a pension plan, the company may not take away the vested funds. Most companies have a five year rule before you become “vested.” Some companies use a graduated vested rule.

Regardless, these rules must be available and clear to all employees. ERISA also ensures that federal laws are followed regarding healthcare. For instance, if your employment ends, you may COBRA, or extend, your health insurance. You will pay the cost, but you must be allowed to carry that insurance for 18 months. Additionally, all companies must adhere to HIPPA regulations. Consequently, employers and employees must understand ERISA’s rules.

Benefits Covered by ERISA

Employers may offer some of the following benefits. ERISA does not dictate which benefits must be offered. However, once a private company offers these benefits, the employer must follow ERISA rules.

- Healthcare

- Dental

- 401K, 403b, IRA with company match

- Short or long term disability

- Life insurance

- Pension plan

- Short or Long-term disability insurance

Does ERISA Apply to All Private Benefit Plans?

No. Government plans and church-based plans are often exempt from ERISA. This exemption has benefits and negative aspects for employers. On the positive side, an employer does not have to follow ERISA’s minimum reporting standards.

In other words, the plan’s funding and asset administration need not be reported. On the down side, employers do not receive state protections against punitive damages regarding their benefit plans. As a result, government and church-based plans require legal assistance before offering benefits to employees.

What Are Some ERISA Violations?

ERISA mandates employers act as a fiduciary regarding any benefit’s assets; have grievance procedures in place, and provide employees with all information on benefit plans. Some violations include:

- Stopping healthcare coverage too soon

- Paying less benefits than promised or accrued

- Denial of benefits

- Failure to follow established retirement or healthcare plans

The ERISA Attorney’s Role

An ERISA attorney may work for an employee or the employer. Since ERISA is a federal law, an experienced ERISA attorney may handle cases from any state.

First, an attorney may assist a company or organization in establishing benefit packages. Second, they may defend an organization, or company that has an ERISA violation. Third, an experienced ERISA attorney may assist an employee whose benefits were denied, or incorrectly calculated. Examples regarding the third case include:

- You were denied long-term disability payments.

- You were denied health insurance.

- Your pension was incorrectly calculated.

- You need help regarding a QDRO (qualified domestic relations order). This is used in divorce cases.

It’s important to note that an ERISA attorney may also handle benefit cases from non-ERISA organizations. Governmental and church-sponsored organizations must follow state and federal laws. As a result, don’t assume you have no protections when you work for one of these organizations. Remember, you have rights and an experienced attorney will ensure your rights are protected. Also, legal counsel remains vital when establishing benefit packages for any business organization.