Florida Estate Fraud

Florida’s sunny weather provides an excellent home for retirees. Many folks enjoy their golden years in the sunshine state. In addition to pleasant, winter weather, Florida has no inheritance tax.

As a result, Florida’s senior citizen population exceeds 4.2 million. Sadly, scammers, friends, and even family members may target seniors in unlawful estate fraud situations. Fortunately, an experienced estate litigation attorney can help you navigate the legal process.

Estate Fraud Examples

Numerous types of estate fraud happen on a regular basis. Some involve estate documents, others involve real estate or stealing one’s assets. Examples include: will and trust fraud, fraudulent property transfers, and mortgage application fraud.

- Will and Trust Fraud – This is an extensive, complicated category. Will and trust fraud may occur when someone takes advantage of an older relative and coerces that person to alter an existing estate document. Usually the change benefits this devious person financially. Undue influence regarding wills and trusts is illegal and must be proven in court. A forged will is another example of estate fraud.

- Fraudulent property transfers – This is a growing problem in Florida. In May, 2022, The Palm Beach Post reported a 20-year-old woman perpetrated a complicated real estate scam. She stole more than $300,000 selling properties that she did NOT own in six Florida counties. She created fictitious title companies, websites, fake email addresses, and title agent identities. More than 45 people fell for her fraudulent schemes. In this case, folks of various ages were affected. So, use an attorney when buying or selling a home in Florida.

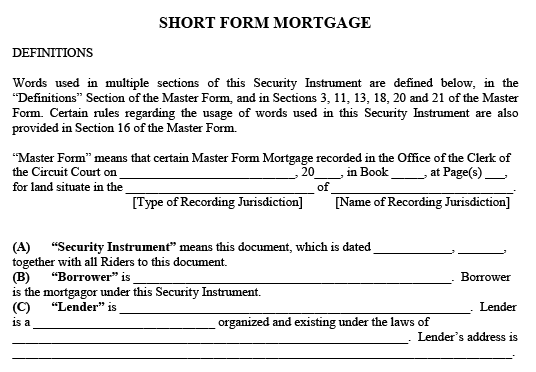

- Mortgage application fraud – This serious offense involves falsifying financial documents to obtain a mortgage loan.

Legal Consequences for Estate Fraud

All estate fraud is illegal and ramifications vary depending on the offense. Will and trust fraud must be proven in probate court. However, forging a will is a third degree felony punishable by up to five years in prison and a fine up to $5000. Of course, there are times when a will is legally signed by a representative with witnesses. An attorney should advise you regarding this process.

Fraudulent property transfers – These matters may be handled in civil or criminal court depending on the scope of the problem. Sometimes civil courts can declare a transfer null and void. In that case, the proper owner may get their property back. However, in large fraud cases where criminals are selling non-existing property; or, when scammers are selling homes that they do NOT own this becomes a criminal case. Either way, hire an experienced attorney for help.

Mortgage fraud is a very serious matter and Florida State Statutes as well as Federal Law covers this crime. Florida Law spells out which documents must be part of a mortgage fraud case. Documents include:

- Mortgage

- Deed

- Appraisals

- House inspections

- Surveys

- All loan applications

- All personal financial information(pay stubs, tax returns, verification of income)

Penalties in mortgage fraud cases are quite severe. If you are accused of this crime, or a victim of this predatory practice, contact an experienced attorney. Failure to do so may land you in Federal Prison for up to 30 years. Additionally, fines may be assessed up to $1,000,000. Once again, call an attorney immediately if you suspect this type of fraud.