Probate For Real Estate Property in Florida

Sometimes when an individual is looking to purchase real estate, they will find that the title is in the name of a deceased person. The information surrounding the rightful ownership of the title can often be murky and when this happens, the property can be subject to probate. In Florida, this is handled by the probate courts. This can be handled by multiple types of probate proceedings, depending on the situation.

Sometimes when an individual is looking to purchase real estate, they will find that the title is in the name of a deceased person. The information surrounding the rightful ownership of the title can often be murky and when this happens, the property can be subject to probate. In Florida, this is handled by the probate courts. This can be handled by multiple types of probate proceedings, depending on the situation.

In order for a property to be subject to probate, the ownership of the property must be solely in the decedent’s name. This also applies if ownership of the property is in the decedent’s name with other person’s names as tenants in common without the right of survivorship. Depending on other circumstances surrounding the probate of the property, one of several types of probate proceedings will be used.

In certain situations, a piece of property is not subject to probate, which means the title passes to another person without the need for probate administration. The first instance where this can happen is when the decedent was married at the time of death and the property was held by husband and wife.

Another is if ownership is held by the decedent and other persons as joint tenants with the right to survivorship. A third is if the decedent’s ownership interest was a life estate with a remainder interest to another – as an inheritance. Lastly, there are instances where the ownership of the property is contained within a trust and therefore does not need to be probated.

Types of Probate for Florida Real Estate

There are several different types of probate for real estate in Florida. Below we will detail and explain each type.

Formal Administration – This is the type of probate people associate most with real estate. This is applicable when the value of the decedent’s estate exceeds $75,000 or if their will directs formal administration. In order to start formal administration, an interested party must file a petition with the court to open the decedent’s estate and admit their will to probate if they have one. The court then appoints a representative to administer the estate, who has authority to sell any real property in Florida. This representative also determines whether the decedent has any outstanding debts owed, and if so they use the value of the property to settle those debts. They then determine the beneficiaries shares and distribute the assets of the estate to them.

Summary Administration – In situations where the value of the real estate is less than $75,000 or the decedent has been dead for more than two years without a will directing formal administration, summary administration is used. Instead of a representative, the court will issue an Order of Summary Administration which distributes assets to the beneficiaries. In order for real estate covered under this order to be sold, the contract and deed must be signed by all beneficiaries.

Ancillary Administration – Used for situations where decedents owned real estate in Florida but were not Florida residents. Probate proceedings from the decedent’s state of residency are transferred to Florida and an Ancillary representative is appointed, at which point the procedure is similar to Formal Administration.

Admission of Will from Foreign Probate to Record in Florida – This is used in certain cases where the decedent was a resident of a state other than Florida, and the probate in that state will have already been completed and closed. Under Florida law, there is a procedure to address this situation and allow the probate of the decedent’s Florida real estate. The decedent must have a will that can be admitted to record under Florida law, providing that it had already been admitted to the probate court in the state of their residency.

These laws are outlined in The State of Florida’s Probate Code Chapter 734.104. Below is an excerpt from this section of Florida’s Legislature.

“A petition to admit a foreign will to record may be filed by any person and shall be accompanied by authenticated copies of the foreign will, the petition for probate, and the order admitting the will to probate.” (Florida Legislature Chapter 734, 2019, PROBATE CODE: FOREIGN PERSONAL REPRESENTATIVES; ANCILLARY ADMINISTRATION)

If these requirements are met, the Florida court may be petitioned to admit an authenticated copy of the decedent’s will to record. The persons named in the will can then receive the property with the full title and authority to sell the property.

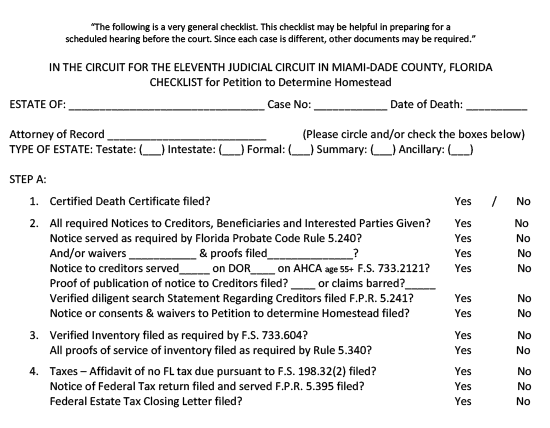

Determination of Homestead – Technically this is a special procedure that falls within Formal Administration. Under this procedure, the court issues an Order Determining Homestead that distributes the homestead to beneficiaries in a will or persons entitled to the property by law if there is no will. Because homesteads owned by beneficiaries who are either spouses or lineal descendants are exempt from the decedent’s creditors, this is often used to prevent the decedent’s creditors from trying to claim portions of an estate to repay outstanding debts. If the homestead were to be sold, the sale must be made by the beneficiaries named in the Order.

To provide an example of what’s involved in this process, here’s a PDF example of a checklist for a Petition to Determine Homestead form from the Probate Court in Miami-Dade County.

Florida Probate Real Estate Lawyers

As experienced lawyers for probate and estate planning, Di Pietro Partners assists clients with issues involving the probate of real estate property all throughout Florida. Our law firm has decades of experience in various courts throughout the State and can help ensure homestead is properly determined and that real estate property is correctly administered during the probate process.

If you have issues or questions regarding probate real estate in Florida, contact our attorneys for a free consultation today.