Balance Billing in Florida’s Medical Practices

Medical billing remains one of the most complicated areas of payment collection. First of all, each patient is unique regarding medical coverage. Some patients have private insurance coverage, many have government insurance like Medicare or Medicaid, and others lack medical insurance, or prefer private pay for services.

Additionally, car accident victims may rely on auto insurance companies to pay for medical care. Regardless of coverage, patients often receive a bill from a hospital, doctor’s office, anesthesiologist, lab, or other service provider indicating a “balance” on their account.

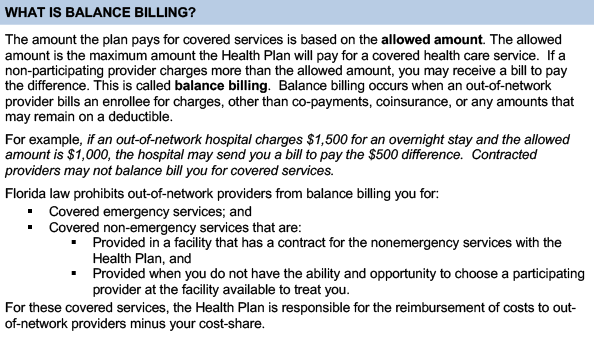

This balance indicates that the insurance provider did not pay the full amount billed by the medical establishment. In order to protect medical providers and patients, Florida Law regulates Balance Billing by medical providers.

Medical Insurance Terms

Private healthcare insurance or government healthcare insurance utilizes various terms. It’s important to understand this terminology before discussing balance billing.

- Deductible- Before an insurance plan pays for any health services (other than a yearly physical), you must meet your deductible. So, if your plan has a $1500 deductible, you will pay $1500 for any medical services before insurance pays.

- Coinsurance- Some plans have a coinsurance amount. This amount varies depending on the plan. For example, your plan may have a 10% coinsurance amount. Basically, you must pay 10% of all medical costs after you meet your deductible. There is usually a “cap” or out of pocket limit on this amount.

- Copayment- A copay is a set rate you pay for doctor visits and prescriptions.

- In-network/Out-of-network- Insurance companies coordinate with hospitals and medical practices to accept specific payments for services when you use an in-network provider.

Usually, plans with lower monthly premiums have higher deductibles, coinsurance, and copays.

When is Balance Billing a Problem?

Problems may arise when a patient receives unexpected emergency care. In these situations, a patient rarely knows every medical professional that administers services. So, even care received at an in-network hospital, may include visits by an out-of-network physician or specialist.

Out-of-network providers charge more so you may get a higher than expected bill. The out-of-network charges are higher because costs are not negotiated in advance with the insurance company. However, if the hospital and provider is in-network, they have pre-negotiated rates for services. For this reason, they may not bill you for more than the insurance company is willing to pay. Remember, this does not include paying your deductible, coinsurance, or copays.

In other words, patients may receive bills. However, in-network medical practices may not bill for more than the amount that is pre-negotiated with participating insurance companies. Basically, these bills are complicated and may require an attorney’s assistance. So, any patient or medical professional that requires assistance regarding balance billing issues should contact an experienced healthcare law attorney.

No Surprises Act

In late December, 2020, Congress passed the No Surprises Act. This legislation takes effect January 1, 2022. This bill aims to prevent “surprises” that could bankrupt an individual. Out of network providers are prohibited from charging patients more than their in-network cost sharing amounts. Out-of-network providers may give services with the written, informed consent of the patient. There are a few exceptions to the written consent:

- No in-network providers are available

- The out-of-network medical professional is a specialty provider such as a radiologist, anesthesiologist, pathologist, or others.

The Act does require estimates for services. The No Surprises Act is quite long and complex. Consequently, medical professionals and billing personnel should study this new legislation and seek legal advice to assist understanding the new law.

Florida Statute of Limitations for Medical Bills

The statute of limitations for medical debt in Florida is five years. This time period starts when the patient signs a form before treatment that states they will pay their bill. A hospital, or medical provider may sue to collect monies owed from medical bills. However, the lawsuit must commence within the five year period.