Last wills and testaments include a number of unique terms which often confuse individuals who are not familiar with the probate process. One of the most common terms that confuses individuals is “per stirpes”, which literally is translated to English as “by the branch”. This term refers to how the testor’s assets will be distributed to beneficiaries if they were to predecease the testor.

As an example, let’s say a testor with two children has instructed in their Last Will and Testament that their assets be equally distributed amongst their children “or to their issue, per stirpes”, if they were not to survive the testor. This means that the assets will be divided equally between their children if they were to not survive them.

Sometimes however, a beneficiary will pass before the testor. If this is the case, then the assets originally willed to the beneficiaries would be distributed to their descendants, or closest surviving relatives if there are no direct descendants. So in this example, if one of the two beneficiaries of the testor were to pass, then the assets originally willed to them would be passed onto the direct descendants of the beneficiaries, with the other half going to the original surviving beneficiary.

Dying Without a Will in Florida

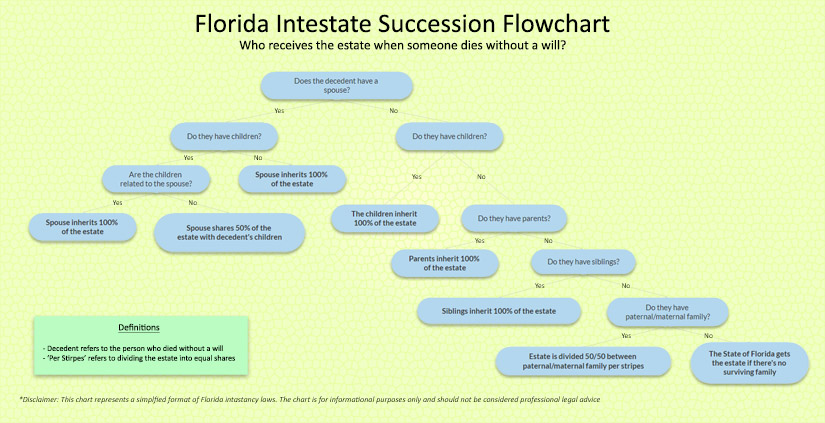

When someone dies without a valid will, their assets are declared intestate. It’s important to note that “intestate” does not mean that the property now belongs to the State. In fact, Florida has a specific process in determining who receives the decedent’s assets in the absence of a valid will. Here’s a simplified flowchart showing who receives assets when someone passes away without a will in Florida.

- When the decedent has a surviving spouse and has no living children, grandchildren, parents, etc, then the spouse shall receive the entire estate.

- If the decedent has a spouse and also has one or more living family members who are family members of the spouse (i.e children), the spouse shall receive the entire estate.

- If the spouse has additional living immediate family members that are not immediate family of the deceased individual, the spouse shall receive one-half of the estate with the other half going to the spouse’s descendants.

- In cases where the decedent was not married at the time of their passing, the immediate family members will receive the entire estate. The assets will then be divided in accordance with Florida law.

- If the deceased person was not married and also has no living immediate family members, the inheritance will pass to surviving parents of the decedent.

- In cases where someone dies without any surviving close family members, spouses, or relatives, the State of Florida will search for more remote heirs in accordance with intestate law.

The full process can be found in Chapter 732 of The Florida Statutes. This process is very in-depth and often causes confusion/disagreements among beneficiaries. As a result, it’s vital to work with a Florida probate attorney that’s experienced with issues involving intestate succession.

Differences with Per Capita

Another common term associated with Last Wills and Testaments is “per capita”, which can create further confusion when discussing the distribution of assets. While per stirpes will ensure that the shares originally willed to surviving beneficiaries will stay the same regardless of whether other beneficiaries pass on, per capita will instead divide the amount evenly among all living descendants.

This means that per the earlier example, if one of the beneficiaries passed away and had three children, the estate would actually be divided into four separate and even parts – one part for the original surviving beneficiary and the other three for each of the deceased beneficiary’s children. Essentially, in a will with per capita, you never create a share for an already deceased beneficiary as would occur in per stirpes.

What This Means for You

The meaning of per stirpes may be different depending on whether you’re having the will prepared or if you’re the beneficiary of the estate. If you are creating a will for your estate then having per stripes included will ensure that your estate is passed down to your children or the next closest descendants in line.

In the event that you are on the other side of the will as a beneficiary or heir and notice per stirpes mentioned in it, it means that the share for any deceased close relatives will go to their descendants if any. Otherwise it will be split evenly between the closest surviving relatives as the will outlines.

Sometimes it can be challenging to understand the details of a will, particularly if there are many beneficiaries listed. In that case, most find it beneficial to work with an attorney specializing in probate and estate planning to help not only formulate the will but also to understand a will, especially when per stripes is involved.