Elective Share and Florida Law

Florida law includes a surviving spouse’s right to an elective share of a deceased spouse’s estate. Florida’s Probate Code Chapter 732 contains this right. Legislators enacted this statute to protect the living spouse’s financial security. The elective share is usually 30% of the decedent’s estate, regardless of the terms of a will or trust. Basically, Florida’s elective share prevents a spouse from being disinherited.

What Is the Elective Estate?

The elective estate includes assets and property used in calculating the elective share. Assets may include: property, bank accounts, retirement plans, stocks, and other items. Since the surviving spouse is entitled to 30% of the elective estate, it remains extremely important to contact an experienced probate lawyer.

Your attorney will guide you through the process of understanding and properly calculating assets. Estate planning legal advisors understand the intricacies of elective share laws. As a result, your attorney will ensure your rights are upheld and respected.

Calculation and Allocation of Elective Share

To calculate an elective share in Florida, first, the total value of the decedent’s elective estate is established. This includes the probate estate, assets in joint tenancy, property in revocable trusts, certain transfers made before death, death benefits from retirement plans, and cash surrender values of life insurance policies.

After determining the value, it’s reduced by outstanding liabilities and expenses. The surviving spouse is then entitled to 30% of this net value. This calculation ensures that the spouse receives a fair and legally mandated portion of the decedent’s estate, regardless of the will’s terms.

How Does the Elective Estate Compare to the Probate Estate?

In Florida, the elective estate and probate estate are two different aspects of estate planning. However, probate assets are included in the elective estate. The elective estate is used when determining a surviving spouse’s elective share rights. One example of when this may be used is when the surviving spouse is excluded from the deceased spouse’s will. In this case, the elective share statute would protect the surviving spouse’s inheritance.

The elective estate includes probate assets and other assets that may avoid probate. Non-probate assets may include:

- Life insurance

- Retirement plans

- Property held in revocable trusts

- Other assets that do not pass through probate

Simply put, the elective estate includes the probate estate assets and other assets that do not go through probate. So, when the 30% elective share is calculated for the surviving spouse most assets are included.

Rights of Pretermitted Spouses

In Florida, pretermitted spouses – those not included in a will because the will was made before marriage – have specific rights. If a spouse marries the testator after the will’s creation and is not mentioned in the will, they may be entitled to an inheritance as if the decedent died intestate (without a will).

This typically means receiving a share equivalent to half or the entire probate estate, depending on other heirs’ existence. This provision ensures that spouses unintentionally omitted from wills due to timing are still protected under estate law.

Dying Without a Will in Florida

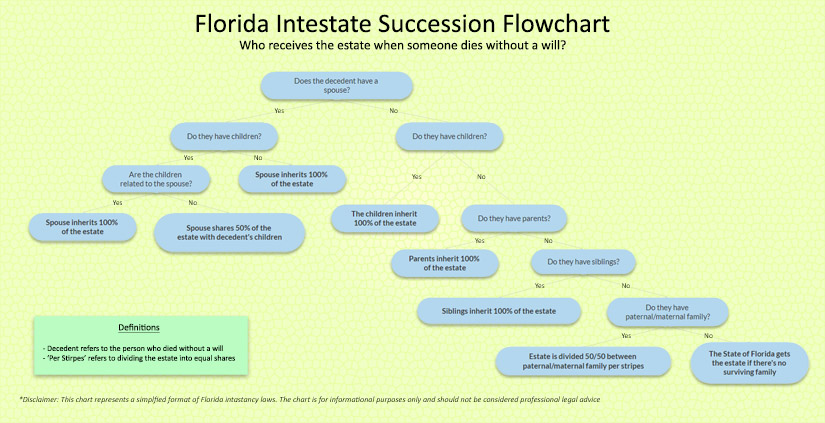

When someone dies without a valid will, their assets are declared intestate. It’s important to note that “intestate” does not mean that the property now belongs to the State. In fact, Florida has a specific process in determining who receives the decedent’s assets in the absence of a valid will. Here’s a simplified flowchart showing who receives assets when someone passes away without a will in Florida.

- When the decedent has a surviving spouse and has no living children, grandchildren, parents, etc, then the spouse shall receive the entire estate.

- If the decedent has a spouse and also has one or more living family members who are family members of the spouse (i.e children), the spouse shall receive the entire estate.

- If the spouse has additional living immediate family members that are not immediate family of the deceased individual, the spouse shall receive one-half of the estate with the other half going to the spouse’s descendants.

- In cases where the decedent was not married at the time of their passing, the immediate family members will receive the entire estate. The assets will then be divided in accordance with Florida law.

- If the deceased person was not married and also has no living immediate family members, the inheritance will pass to surviving parents of the decedent.

- In cases where someone dies without any surviving close family members, spouses, or relatives, the State of Florida will search for more remote heirs in accordance with intestate law.

The full process can be found in Chapter 732 of The Florida Statutes. This process is very in-depth and often causes confusion/disagreements among beneficiaries. As a result, it’s vital to work with a Florida probate attorney that’s experienced with issues involving intestate succession.

Is It Possible to Disinherit a Spouse in Florida?

The elective share statute makes it almost impossible to disinherit a spouse in Florida. However, two ways to limit or remove a spouse from inheritance include: prenuptial agreement, or postnuptial agreement.

Each agreement may be utilized to limit the distribution of assets to one’s spouse after death. Any legal strategy must be worked out with an experienced inheritance attorney. An improperly drafted document will not hold up in court. Additionally, all legal documents must be properly notarized and filed with the court when necessary. So, only a top rated attorney should work with you and your spouse on these important documents.

Additional Protections for Surviving Spouses

In Florida, surviving spouses have additional protections beyond the elective share. These include rights to exempt property, which are safeguarded from creditors’ claims and are distributed in addition to any bequests made in a will.

Exempt property typically includes certain household goods, personal effects, and potentially vehicles, ensuring the spouse retains essential assets. Moreover, a surviving spouse may claim a family allowance of up to $18,000, intended to support them during the estate administration process. These rights offer crucial financial support and asset protection to surviving spouses during a challenging transitional period.

These provisions work alongside the elective share, which ensures a portion of the estate’s value, to offer comprehensive protection and support for the surviving spouse, addressing both immediate needs and long-term financial interests.

Wills, Trusts, and Elective Share Law

Proper estate planning prevents complicated court cases regarding inheritance issues. Couples should meet with a lawyer who understands family law as well as estate planning and probate. This prevents future complications and costs later on.

The estate plan includes: a will, trust, power of attorney, healthcare surrogate, and other important legal documents. Since Florida law protects surviving spouses from being disinherited, it appears to be a waste of time and money to write a will that attempts to do so. In fact, the elective share law prevents you from disinheriting your spouse. That being said, protect your family and your financial future with a solid, legally sound estate plan.