When someone passes away without a will in the State of Florida, assets are distributed through the probate court system. It’s important to note that Florida Law requires that a lawyer be present throughout this process in order to ensure fair distribution of the assets of the decedent.

Di Pietro Partners is a premier law firm for probate and estate cases in Florida. If you have issues involving probate in Tampa, talk to one of our experienced probate lawyers today.

Our Tampa Probate Lawyers on TV

Attorney David Di Pietro appeared on national TV to provide his legal insight for the infamous Brittany Spears probate litigation dispute involving conservatorship. David is the managing partner at Di Pietro Partners and is experienced in probate cases all across Florida including the City of Tampa.

-

+ Probate Definitions (Click to Expand)

To help readers better understand the context of the page, here are some of the most common terms found within this content and/or used throughout the probate process.

Administration – This refers to the legal distribution of someone’s assets in Probate Court after they pass away.

County Clerk of Court – In Florida, most probate hearings are done through the County Clerk of Court in the County in which the decedent resides at the time of their death. This is not to be confused with an actual clerk in the courtroom.

Decedent – A deceased individual

Intestate – When someone dies without a valid will, the State of Florida declares the property of the deceased “intestate.” This will be discussed further in the page.

Probate Court – This is commonly used to describe the court at which the probate hearing takes place even though most hearings are done at the County Clerk of Court.

Personal Representative – Someone who’s legally appointed to oversee the distribution of assets from a deceased person’s estate.

Beneficiary/Beneficiaries – An individual, or group of individuals who are named in a will/estate plan to receive a certain amount of someone’s assets after this person passes away or becomes unable to manage their assets.

Executor – Someone written in a will or delegated by the court to take care of a deceased individual’s financial obligations.

Notice of Administration – Formal notice given to beneficiaries and other interested parties by the personal representative. The notice is legally required in Florida and serves the purpose of providing specific details on the probate proceedings.

Probate Litigation – Basically, this is used to describe a legal dispute during the probate process. The most common types of probate disputes include: challenges to wills/trusts, legal disputes over guardianship, etc.

Tampa Probate Lawyer Legal Services

The Florida probate lawyers at Di Pietro Partners offer a multitude of legal services related to probate in Tampa. These legal services include but are not limited to:

Probate Administration – This involves managing the probate process, including filing paperwork with the court, notifying creditors and heirs, and distributing assets to beneficiaries. An attorney can help guide the executor of the estate through this process and ensure everything is done according to Florida law.

Trust Administration – Trustees have a legal responsibility to distribute assets within the trust to the named beneficiaries in accordance with the wishes of the deceased. It’s vital to work with an attorney that’s experienced with probate and trusts to ensure the correct process is followed.

Trust Litigation – Trust litigation lawsuits involve legal disputes over the administration of trusts. For example, if someone believes they aren’t receiving a proper share of assets within the trust, or have legal objections regarding the actions of a trustee, they may file a legal dispute and the estate may enter litigation. Our probate and trust litigation lawyers have decades of experience representing trustees, beneficiaries, and other parties involved in trust litigation lawsuits.

Will Contests – Sometimes, disputes arise over the validity of a will or the intentions of the deceased. An attorney can help represent interested parties in these disputes and advocate for their rights.

Estate & Probate Litigation: In some cases, disputes may arise over the distribution of assets or the actions of an executor or trustee. An attorney can help represent clients in these disputes and work to resolve them through negotiation or litigation.

Intestate Succession (Dying Without a Will) – Intestate succession refers to the State process of distributing a person’s assets when they die without a will, or trust. When a person passes away without a written document detailing how to distribute their estate, the matter goes to probate court. The State of Florida requires that an attorney is present throughout this process. Since the process involved with intestate succession is very in-depth, it’s vital to work with an attorney who’s experienced with probate cases.

Guardianship – If a person becomes incapacitated and unable to make decisions for themselves, a court may appoint a guardian to make decisions on their behalf. An attorney can help clients navigate the guardianship process and ensure the best interests of the incapacitated person are represented.

Overall, probate legal services in Tampa are focused on helping clients navigate the legal complexities of the probate process and ensuring that the wishes of the deceased are carried out in a timely and appropriate manner.

Probating A Will

When it comes to probating a will in Florida, the process is fairly straightforward. Depending on the value of the decedent’s estate, there are three primary types of administration. This value is calculated by quantifying the total amount of property owned by the deceased individual that’s going through the probate process.

Formal Administration – This is typically the most common type of administration used in probating a will. This administration applies to estates valued over $75,000.

Summary Administration – This form of probate administration is used when the total estate value is $75,000 or less. It’s essentially an expedited version of the probate process.

Disposition Without Administration – This version of probate can only be used when the decedent did not leave behind any real estate property and the assets that can be probated are valued below the costs of probate proceedings themselves.

Our Tampa Probate Attorneys Answer Your Questions

Whether you’re a beneficiary in a decedent’s estate, or a loved one passed away without a will, you most likely will have questions about Florida’s probate process.

The probate attorneys at Di Pietro Partners understand that this is most likely a confusing and overwhelming time for you; thus, for the benefit of the reader, we’ve done our best to provide answers to some of the most frequently asked probate questions.

Tampa Probate FAQs

-

+ What is Probate?

Probate refers to a legal procedure for settling the affairs of a deceased person. It incorporates the authentication of the will, taking inventory of the individual’s assets, appraising these assets, settling debts and taxes, and distributing the leftover property as per the will or statutory law. Certain smaller estates might bypass probate via methods such as joint ownership or living trusts.

-

+ What is a Probate Lawyer?

A probate or estate attorney aids executors, administrators, or beneficiaries in navigating the probate process following a person’s death. They assist in activities such as estate planning, gathering life insurance proceeds, appraising and securing the decedent’s property, addressing debts, drafting legal documents, and allocating assets in accordance with the will or statutory law. The intricacy of the estate and prevailing laws can determine the extent of their involvement.

-

+ What Are Probate Laws in Tampa?

Probate legislation in Tampa, Florida, adheres to the Florida Probate Code. Critical aspects encompass formal administration for more substantial estates, summary administration for smaller or older estates, limited instances of disposition without administration, special provisions for primary residences, and state laws dictating distribution in the absence of a will. Probate affairs are resolved by the Hillsborough County court. It is always recommended to consult a Tampa probate lawyer for precise guidance.

-

+ How Long Does Probate Take in Tampa?

The probate process in Tampa, Florida, might extend from a few months to more than a year, contingent on factors such as the complexity of the estate, potential disputes over the will, the settlement of debts and taxes, and the court’s schedule. To obtain a more accurate prediction, consider consulting a local probate attorney.

-

+ What Happens if You Die Without a Will in Tampa?

If you pass away without a will in Tampa, Florida, your estate will be divided according to Florida’s intestate succession laws. A surviving spouse and descendants share the estate. If only a spouse, descendants, parents, or siblings survive, they inherit the entire estate. More complicated scenarios involving half-siblings, grandparents, or distant relatives necessitate consultation with a probate lawyer.

-

+ What Court Do Tampa Probate Cases Go Through?

In Tampa, Florida, the Probate Division of the Thirteenth Judicial Circuit Court of Florida in Hillsborough County processes probate cases. This court supervises the administration of estates, which includes distributing assets as per a will or the state’s intestacy laws if a will is absent. It is always wise to enlist legal advice when going through the probate process.

-

+ What is The Average Cost of a Tampa Probate Lawyer?

The average expenditure for a probate attorney in Tampa can significantly fluctuate based on various factors, such as the intricacy of the case, the attorney’s experience, and the law firm’s pricing model. Some lawyers may bill an hourly fee, while others might charge a flat fee or a percentage of the estate’s value.

Hourly charges for probate attorneys in Tampa typically fall between $200 to $400. More seasoned attorneys or those with specialized expertise may demand higher rates. Flat fees can span anywhere from $2,500 to $10,000 or more, depending on case specifics.

For straightforward, uncontested probate cases, you may anticipate costs between $2,500 and $5,000. However, for more involved cases or those involving conflicts, the expense could substantially rise, potentially exceeding $10,000.

Overall, the cost of hiring a probate lawyer in Tampa can range from a few thousand dollars to tens of thousands of dollars, depending on the circumstances. At Di Pietro Partners, our Tampa probate attorneys offer a free 30 minute consultation where we can discuss your individual case including fees and payment arrangements with full transparency.

Dying Without a Will in Tampa

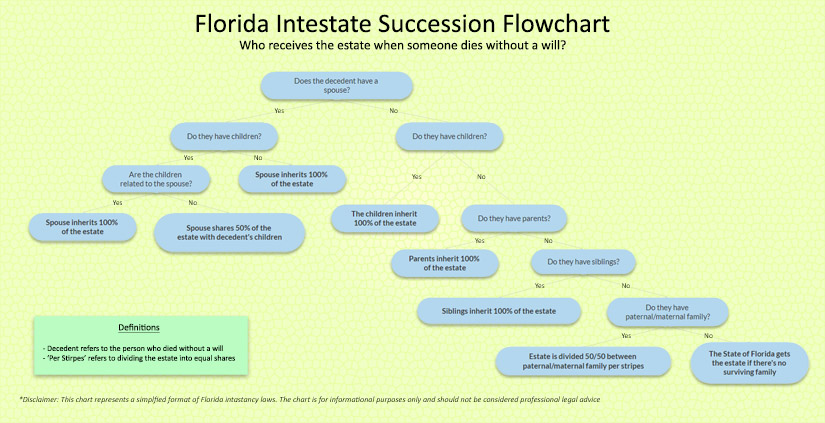

When someone dies without a valid will, their assets are declared intestate. It’s important to note that “intestate” does not mean that the property now belongs to the State. In fact, Florida has a specific process in determining who receives the decedent’s assets in the absence of a valid will. Here’s a simplified flowchart showing who receives assets when someone passes away without a will in Florida.

- When the decedent has a surviving spouse and has no living children, grandchildren, parents, etc, then the spouse shall receive the entire estate.

- If the decedent has a spouse and also has one or more living family members who are family members of the spouse (i.e children), the spouse shall receive the entire estate.

- If the spouse has additional living immediate family members that are not immediate family of the deceased individual, the spouse shall receive one-half of the estate with the other half going to the spouse’s descendants.

- In cases where the decedent was not married at the time of their passing, the immediate family members will receive the entire estate. The assets will then be divided in accordance with Florida law.

- If the deceased person was not married and also has no living immediate family members, the inheritance will pass to surviving parents of the decedent.

- In cases where someone dies without any surviving close family members, spouses, or relatives, the State of Florida will search for more remote heirs in accordance with intestate law.

The full process can be found in Chapter 732 of The Florida Statutes. This process is very in-depth and often causes confusion/disagreements among beneficiaries. As a result, it’s vital to work with a Florida probate attorney that’s experienced with issues involving intestate succession.

Tampa Probate Litigation Attorney

A Tampa probate litigation attorney is a legal professional who specializes in handling disputes and contested matters that arise during the probate process in Tampa, Florida. Probate is the legal process by which a deceased person’s estate is administered, their debts are settled, and their assets are distributed to the heirs or beneficiaries. While many probate matters are resolved without any issues, disputes can sometimes arise, and that’s when a probate litigation attorney steps in.

Some of the key responsibilities and tasks performed by a Tampa probate litigation attorney include:

- Representing clients: The attorney represents parties involved in the probate litigation, which could include beneficiaries, heirs, personal representatives, executors, administrators, or creditors of the deceased person’s estate.

- Assessing the validity of a will: If there’s a dispute over the validity of the deceased person’s will, the attorney may investigate whether the will was executed properly, if the deceased was mentally competent, or if undue influence or fraud was involved.

- Handling will contests: In cases where a will is contested, the attorney represents their client’s interests and argues their case in court.

- Resolving disputes among beneficiaries and heirs: The attorney may assist in resolving conflicts among beneficiaries or heirs, which may include disagreements over the distribution of assets or the interpretation of the will’s provisions.

- Addressing creditor claims: The attorney helps resolve disputes between the estate and its creditors, ensuring that valid claims are paid, and disputing those that are not.

- Advising on fiduciary duties: The attorney may advise personal representatives, executors, or administrators on their duties and responsibilities, as well as defend them if they are accused of breaching their fiduciary duties.

- Negotiating and mediating settlements: In many cases, the attorney may work to negotiate and mediate settlements between disputing parties, aiming to resolve conflicts without the need for a trial.

- Litigating in court: If a settlement cannot be reached, the attorney will represent their client’s interests in court, presenting evidence, examining witnesses, and making legal arguments to support their case.

In summary, a Tampa probate litigation attorney helps navigate the complexities of probate disputes and represents the interests of their clients in court or during settlement negotiations. They provide legal advice, guidance, and advocacy to ensure that the probate process is carried out fairly and in accordance with Florida law.

Filing Tampa Probate Cases

The court that’s responsible for probate in Tampa as well as the rest of Hillsborough County is the Thirteenth Judicial Circuit Court. Our law firm is highly experienced with probate cases within this court system.

13th Judicial Circuit Court of Florida

800 E Twiggs St

Tampa, FL 33602

Get Directions

Trust Administration

Trust administration involves overseeing and managing assets held in a trust. The primary objective of a trust is to safeguard assets while effectively administering and disbursing them to individuals specified in the trust document, known as trustees. Trusts also deliver benefits to beneficiaries throughout their lives.

Generally, trusts are divided into two types – revocable and irrevocable. There are three primary trusts utilized in Florida.

Living Trust – This trust is the most prevalent and can be established as either revocable or irrevocable. It determines the administration of specific assets during an individual’s lifetime and the distribution of those assets after their demise.

Testamentary Trust – Often referred to as a “testamentary will,” this trust is embedded within a will and comes into effect only upon the death of the individual.

Domestic Asset Protection Trust – Frequently abbreviated as DAPT, this trust is designed to guard against creditors and protect assets in case a marriage dissolves.

Talk With A Tampa Probate Lawyer

Di Pietro Partners is an AV Preeminent® rated law firm that specializes in issues involving Florida probate. This includes simple estate administration as well as complex litigation.

We are dedicated to serving Hillsborough County as well as many other locations throughout the State of Florida. Contact one of our experienced attorneys today.

Please note that our Tampa office location is available via appointment only.

100 S. Ashley Drive

Suite 600

Tampa, FL 33602

Get Directions